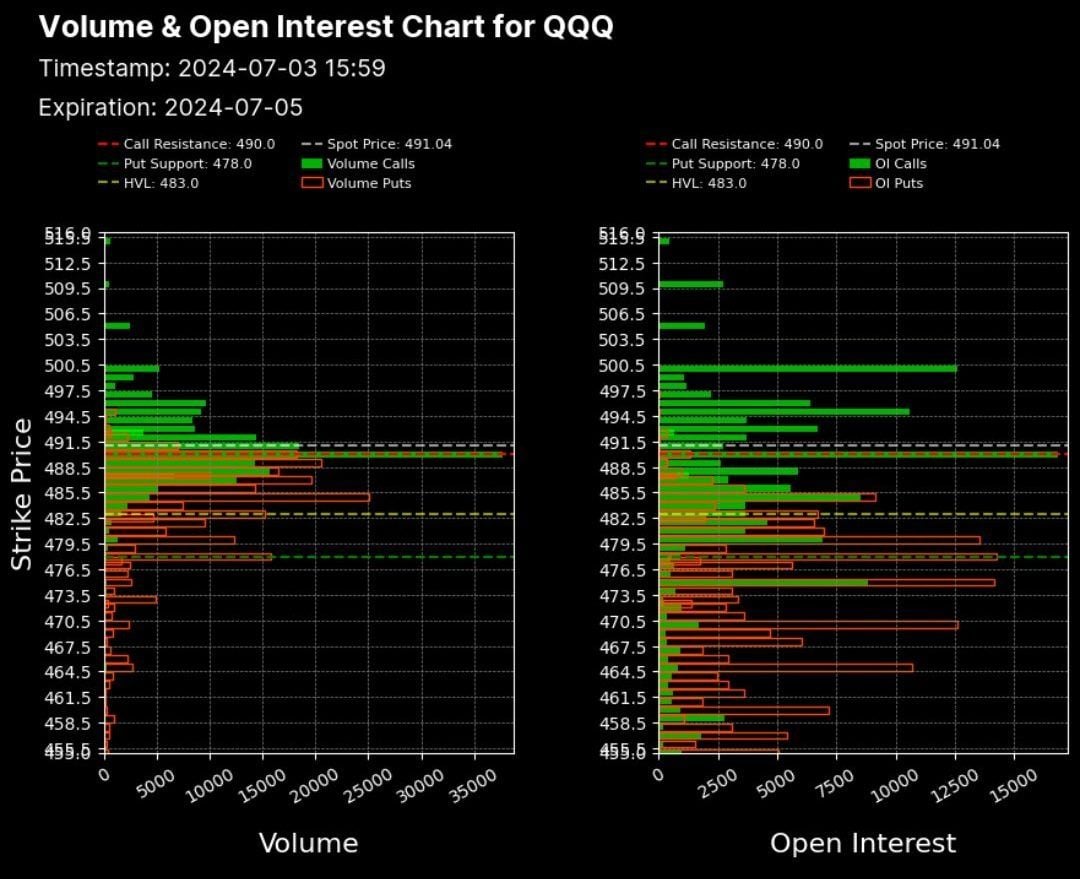

Volume and Open Interest

Discover How Volume and Open Interest Reveal Hidden Trends

The Volume and Open Interest Tracker is key to understand market dynamics and investor sentiment. It provides a comprehensive analysis of trading volume and open interest across various assets and strike prices, enabling users to identify trends, and assess the strength of price movements. By tracking volume, traders can determine the level of participation in a market, while open interest data reveals the number of outstanding contracts, offering insights into market liquidity and positioning. Together, these metrics help traders spot emerging opportunities, and develop effective trading strategies.

-

0DTE Volumes and Open Interest

Our 0DTE Volume and Open Interest Tracker provides in-depth analysis of zero days to expiration options, offering traders crucial insights into market dynamics and investor sentiment. By monitoring trading volumes and open interest, our tool enables users to identify trends, assess the strength of price movements, and gauge market participation and liquidity.

-

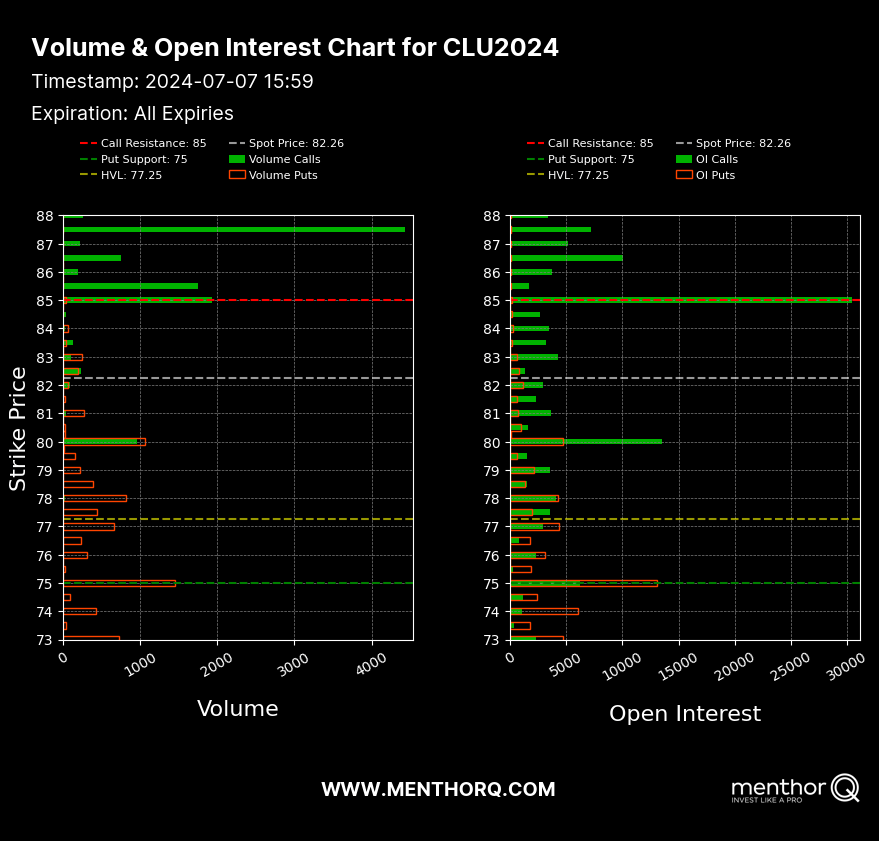

Monitor Institutional Flow

Our Volume and Open Interest Tracker is designed to keep you ahead of the curve by providing a detailed analysis of trading volumes and open interest across all expiration dates. This tool allows traders to monitor the flow of institutional investments, identify significant market trends, and assess the overall market sentiment. By tracking these metrics, users can gain insights into the positioning and strategies of major market players, helping them to anticipate movements and make informed trading decisions.