Term Structure

Unlock the Power of Term Structure for Strategic Trading Advantages

The Term Structure shows how expected volatility for a stock or index varies at different time horizons. This relationship is important because it helps to understand how expected volatility changes over time and how it impacts the price of options.

-

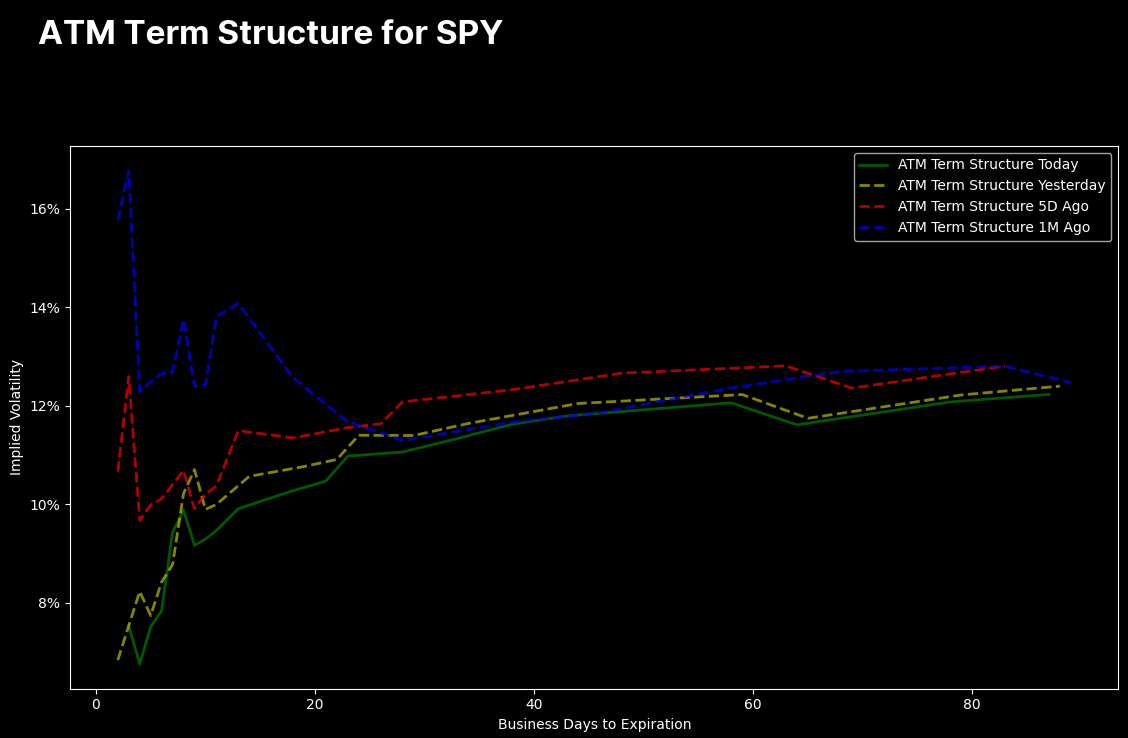

ATM Term Structure

Our ATM (At The Money) Term Structure analysis provides an in-depth view of option pricing and volatility for options that are closest to the current market price. By examining how the term structure changes over time, you can gain insights into market expectations and identify shifts in sentiment. This historical comparison helps you make informed decisions, optimize your trading strategy, and better anticipate market movements.

-

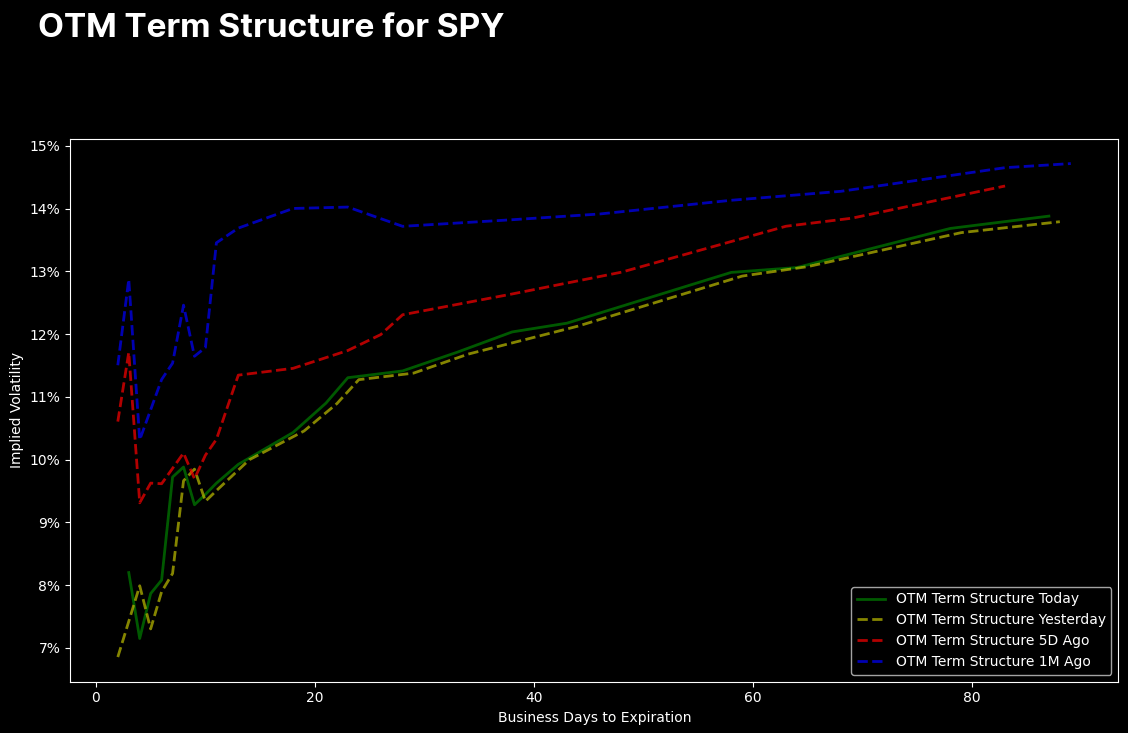

OTM Term Structure

Our OTM (Out of The Money) Term Structure analysis offers a comprehensive look at option pricing and volatility for options that are farther from the current market price. This analysis helps you understand the market’s perception of future price movements and potential risks. By comparing historical changes in the term structure, you can uncover trends and patterns that inform your trading strategy and enhance your ability to capitalize on market opportunities.