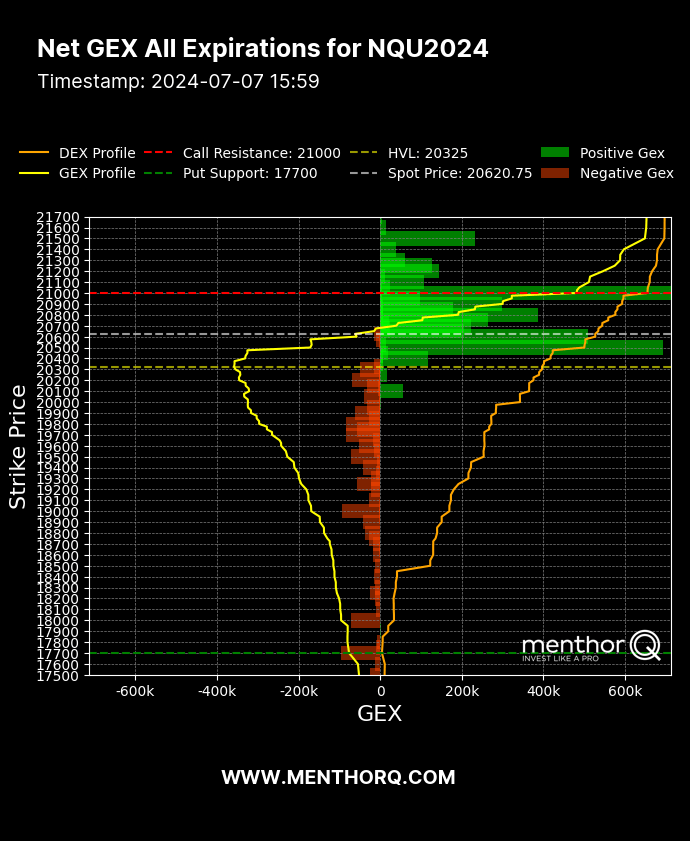

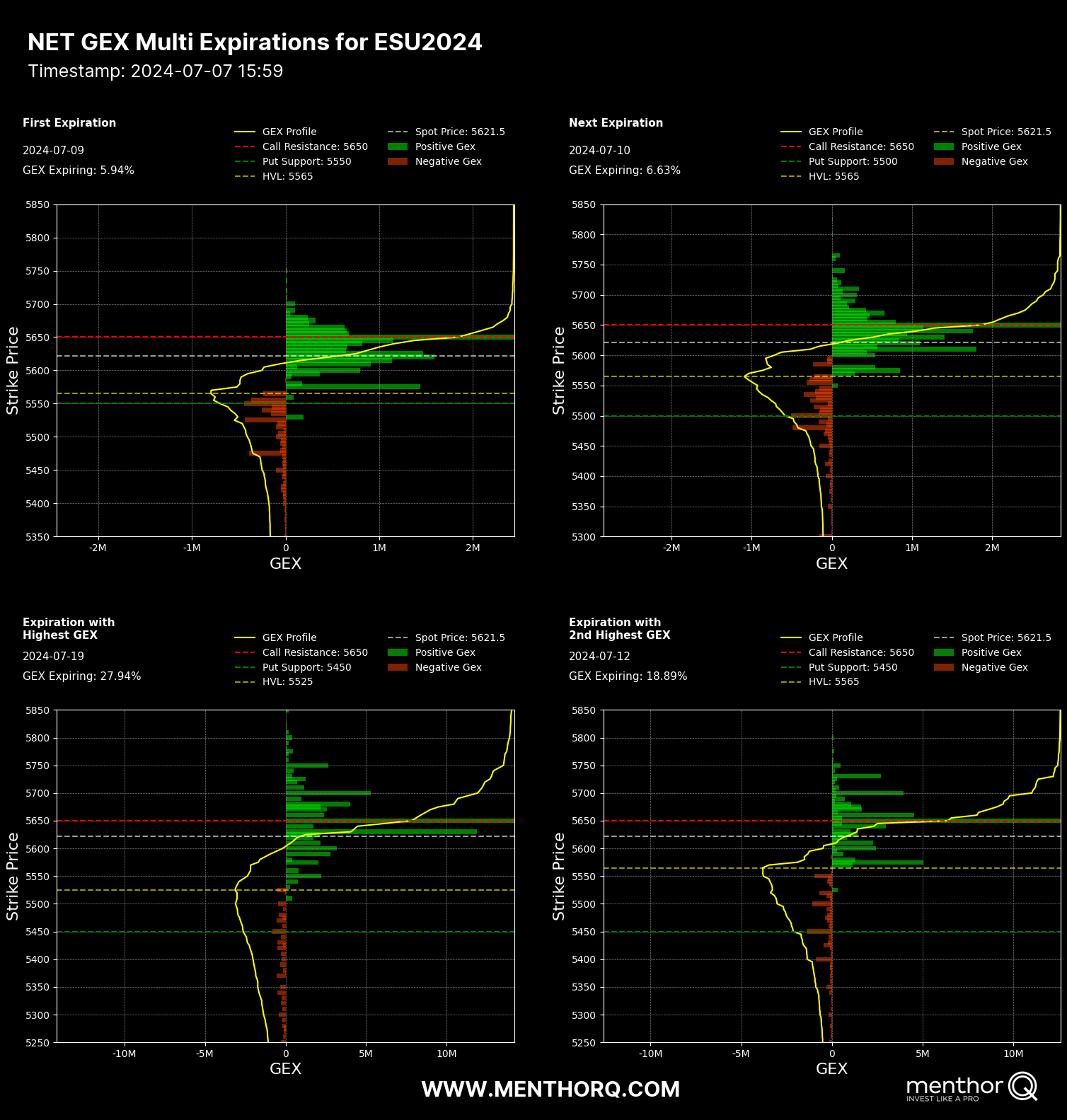

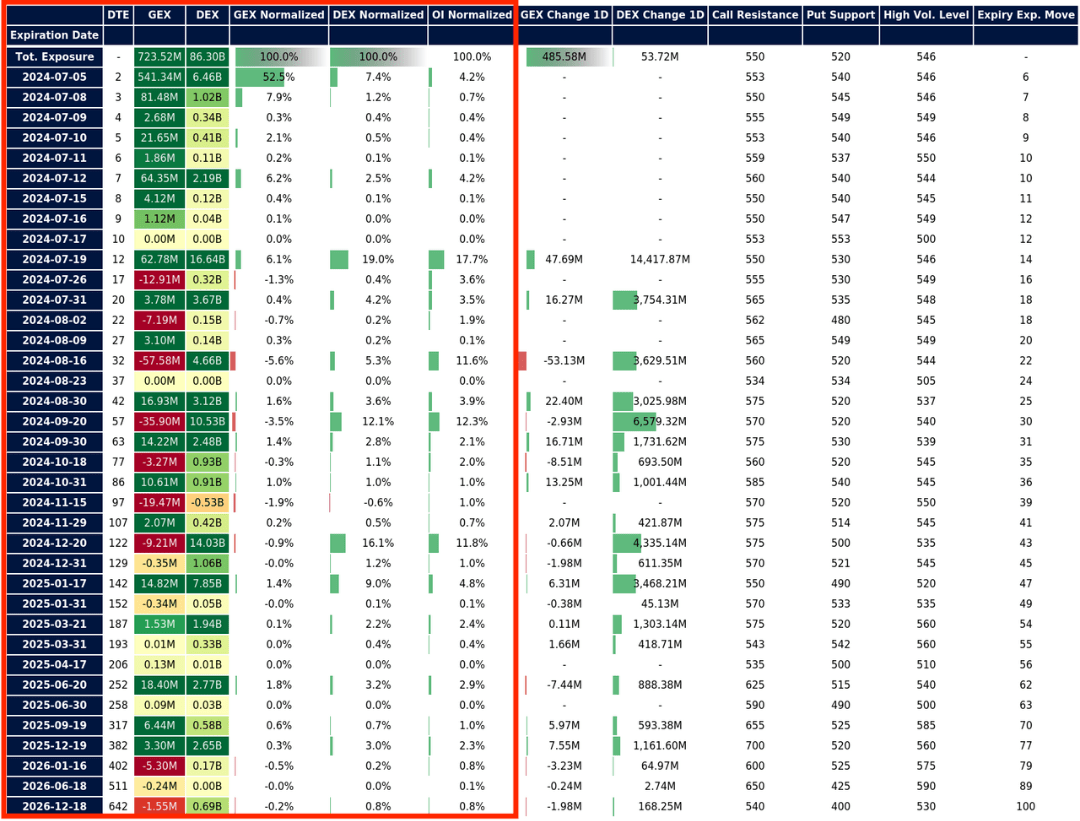

Net Gamma Exposure

Identifying Key Reaction Zones for Strategic Trading

Takes Gamma and Open Interest for calls and puts to provide the Net Gamma Exposure by strike. The strikes with highest positive or negative gamma exposure can become important reaction zones. This can help traders make data driven decision and add an additional level of protection.

-

Undestanding Market Positioning

Net GEX, or Net Gamma Exposure, measures the overall gamma exposure in the market, aggregated from all options on a specific asset. It provides insights into the potential market impact of options positions. Positive Net GEX suggests that market makers will likely dampen volatility by hedging, while Negative Net GEX indicates that market makers may amplify volatility through their hedging activities.

-

Market Liquidity and Volatility

Strikes with the highest positive or negative gamma exposure can become important reaction zones, helping traders make data-driven decisions and adding an additional layer of protection.

Net GEX helps predict whether market volatility will increase or decrease based on market maker hedging activities.

-

Early Warning

Acts as an early warning system for potential market shifts, allowing traders to anticipate and react to changes proactively.