CTAs Models

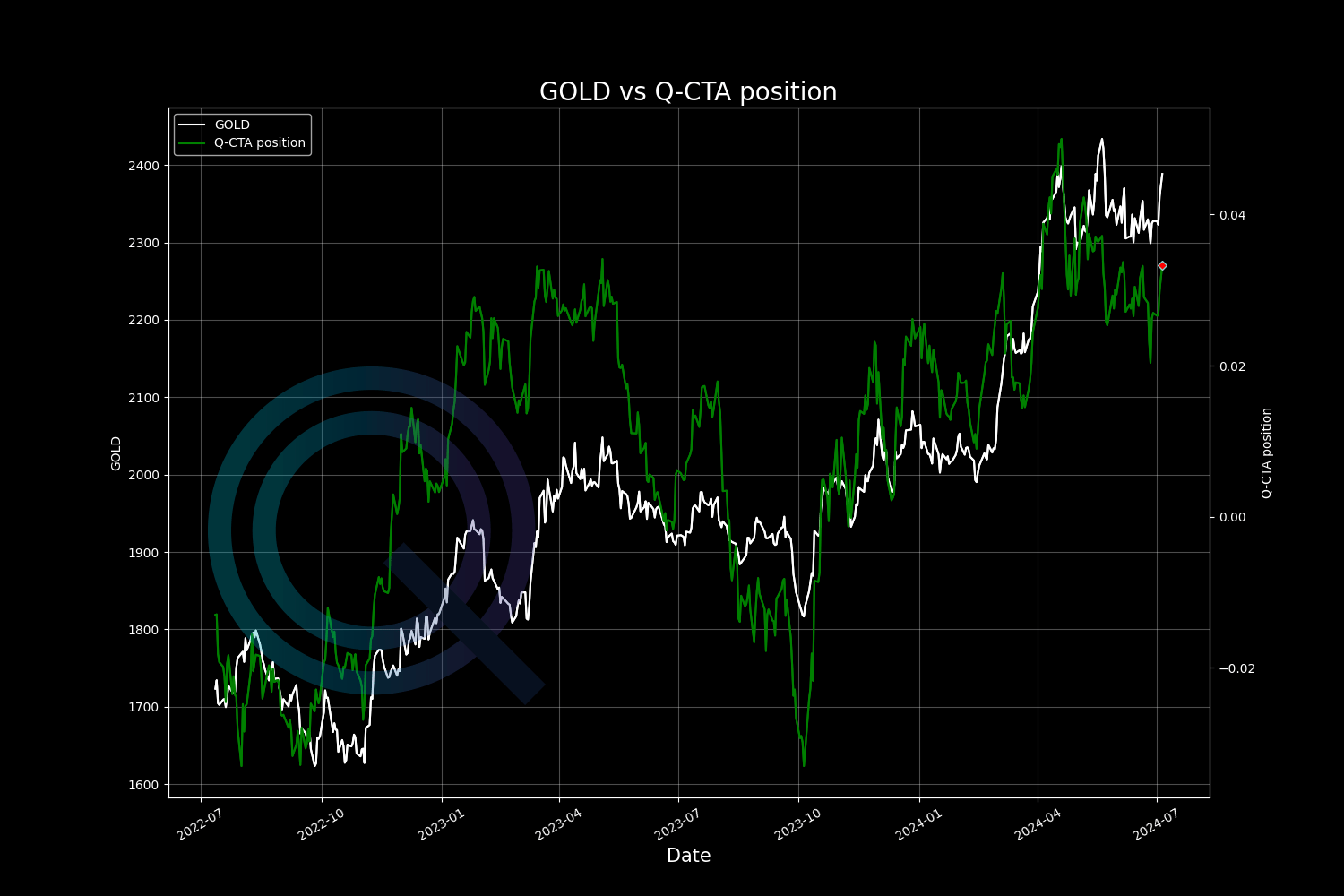

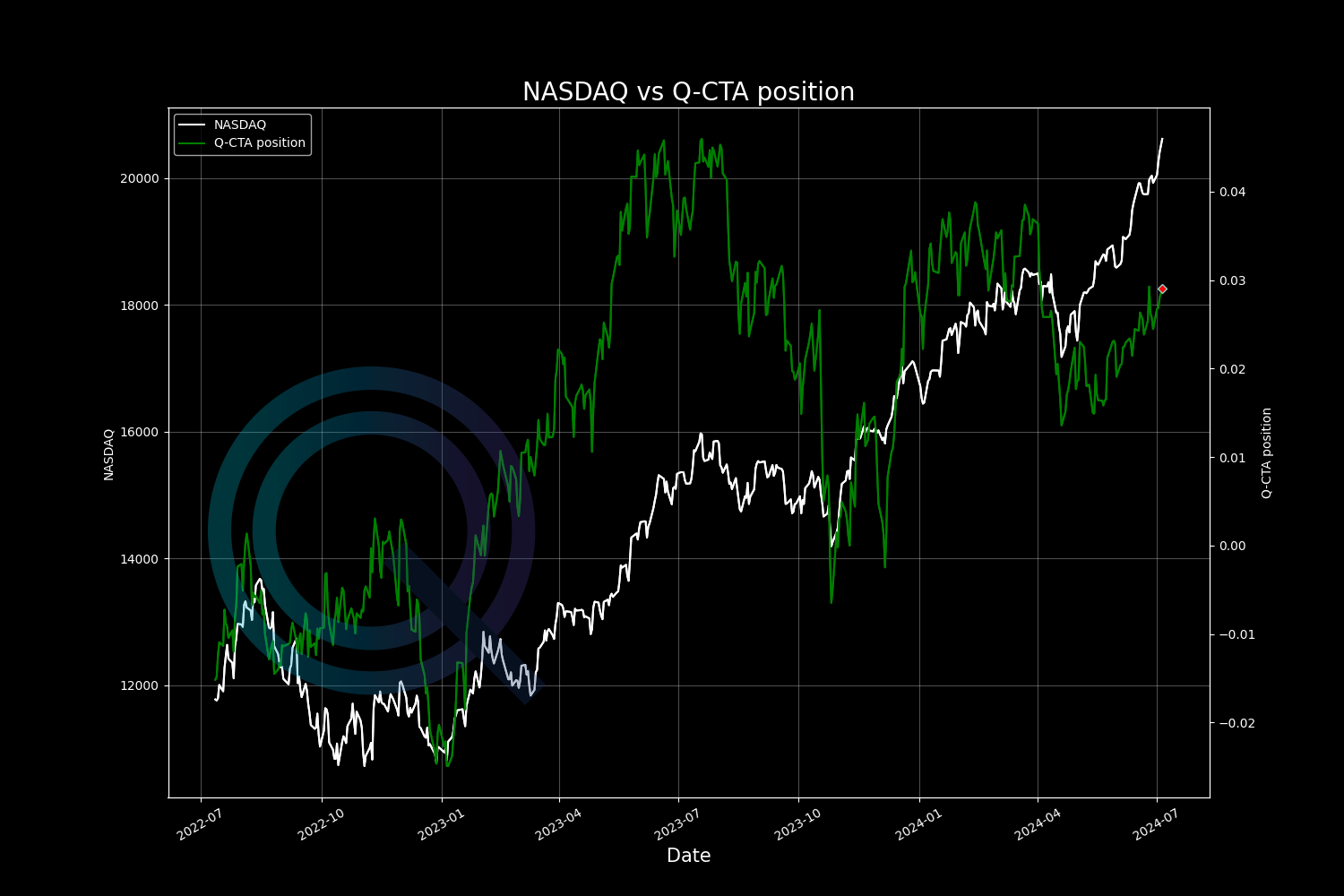

Track the positioning of Systematic Funds

CTAs Funds are important players in the market as they add or remove liquidity based on specific price level triggers. Our CTAs Model help confirm the direction of a trend and can be used in conjunction with our gamma levels for better decision making and risk management.

-

Institutional Positioning

Our CTAs Model leverage proprietary factors similar to those used by investment banks, offering you insights into current positioning based on the latest asset spot prices.

-

Reaction Triggers

Identify CTA positioning and price levels that shape CTA trends, allowing you to pinpoint institutional market reaction zones effectively.

-

Enhanced Market Analysis

Combine CTAs positioning with Q-Models to achieve a more comprehensive market view. For instance, one way is integrating CTAs with Key Levels and the 1D Expected Move provides a clearer understanding of potential reaction zones.

-

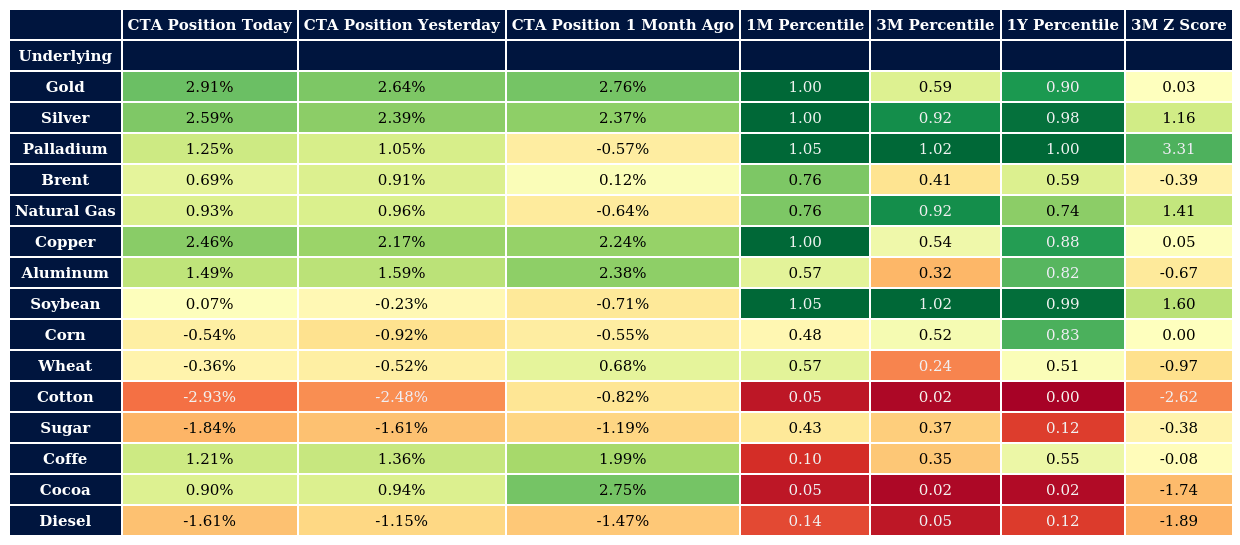

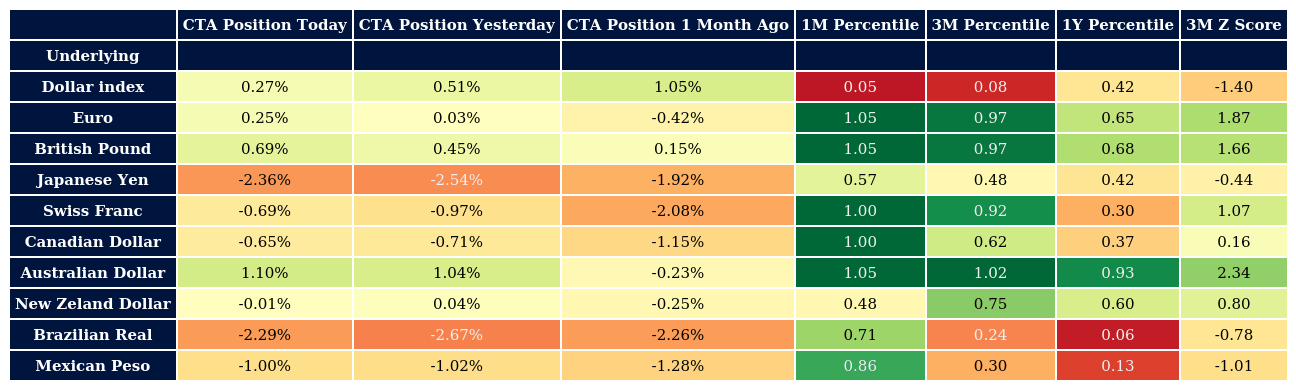

Extensive Coverage

Benefit from extensive coverage across a variety of markets, enabling you to pinpoint CTA positioning and price levels that influence trends and institutional reaction zones.