Gamma Levels on Futures

Step Up Your Futures Trading with Key Gamma Levels

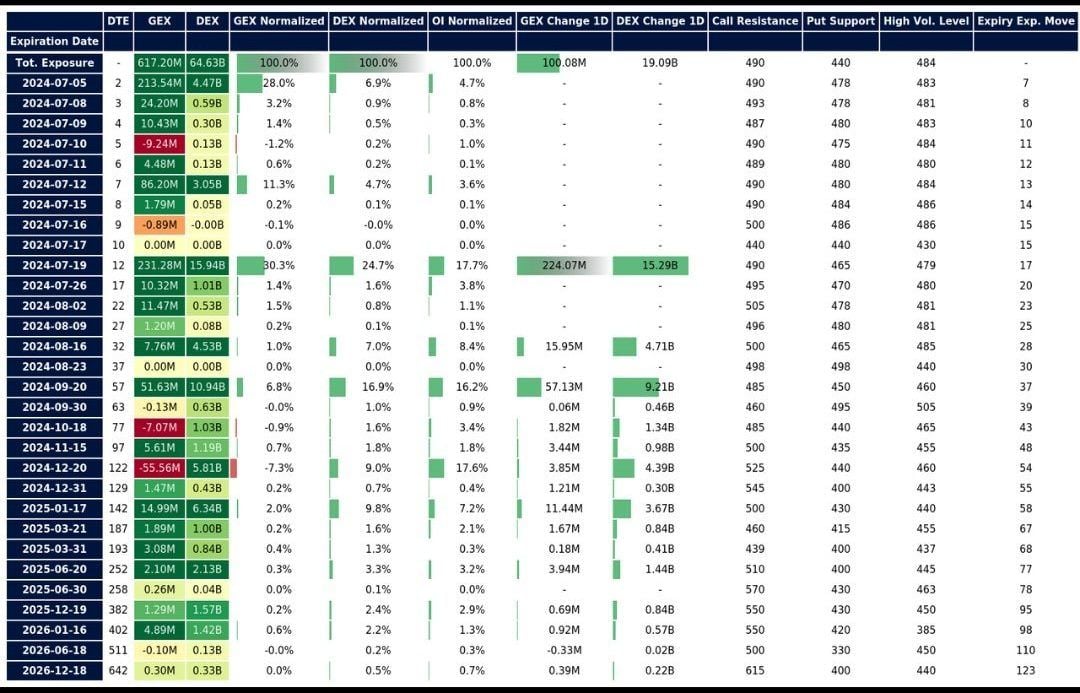

Gamma Levels on Futures help you monitor the gamma exposure of the Market Maker on Futures Options. They are key to understand Market Reaction Zones that could dictate Price Action. You can use these levels on Index, Energy, Metals, Rates, Forex and Soft Commodity Futures.

-

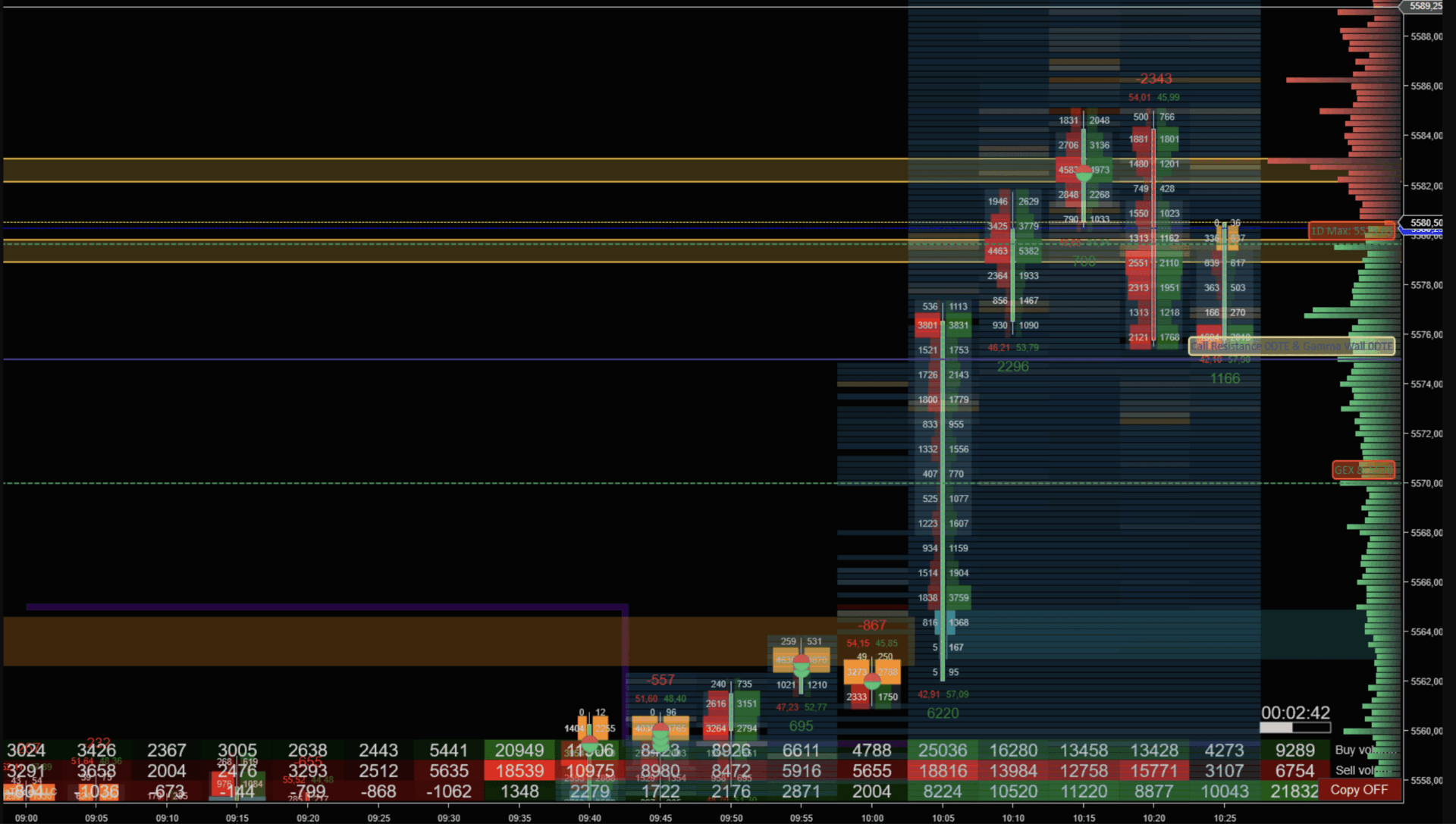

Trading Integration

Seamlessly integrate Gamma Levels into your existing trading platforms to gain a strategic edge. Our tools are designed to complement your current setup, providing real-time insights and enhancing your decision-making process without disrupting your workflow. Use Gamma Levels on NinjaTrader, MetaTrader and TradingView.

-

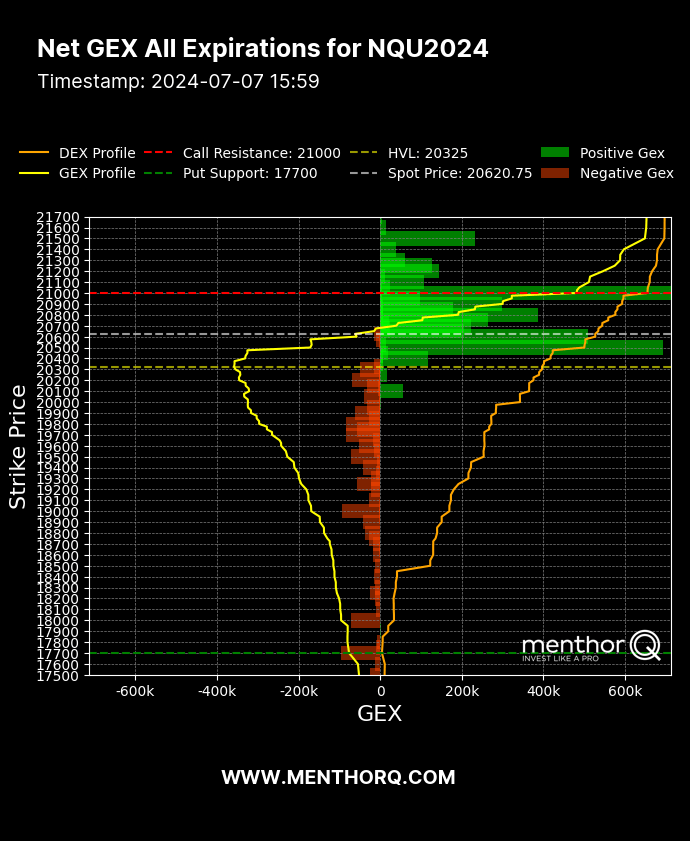

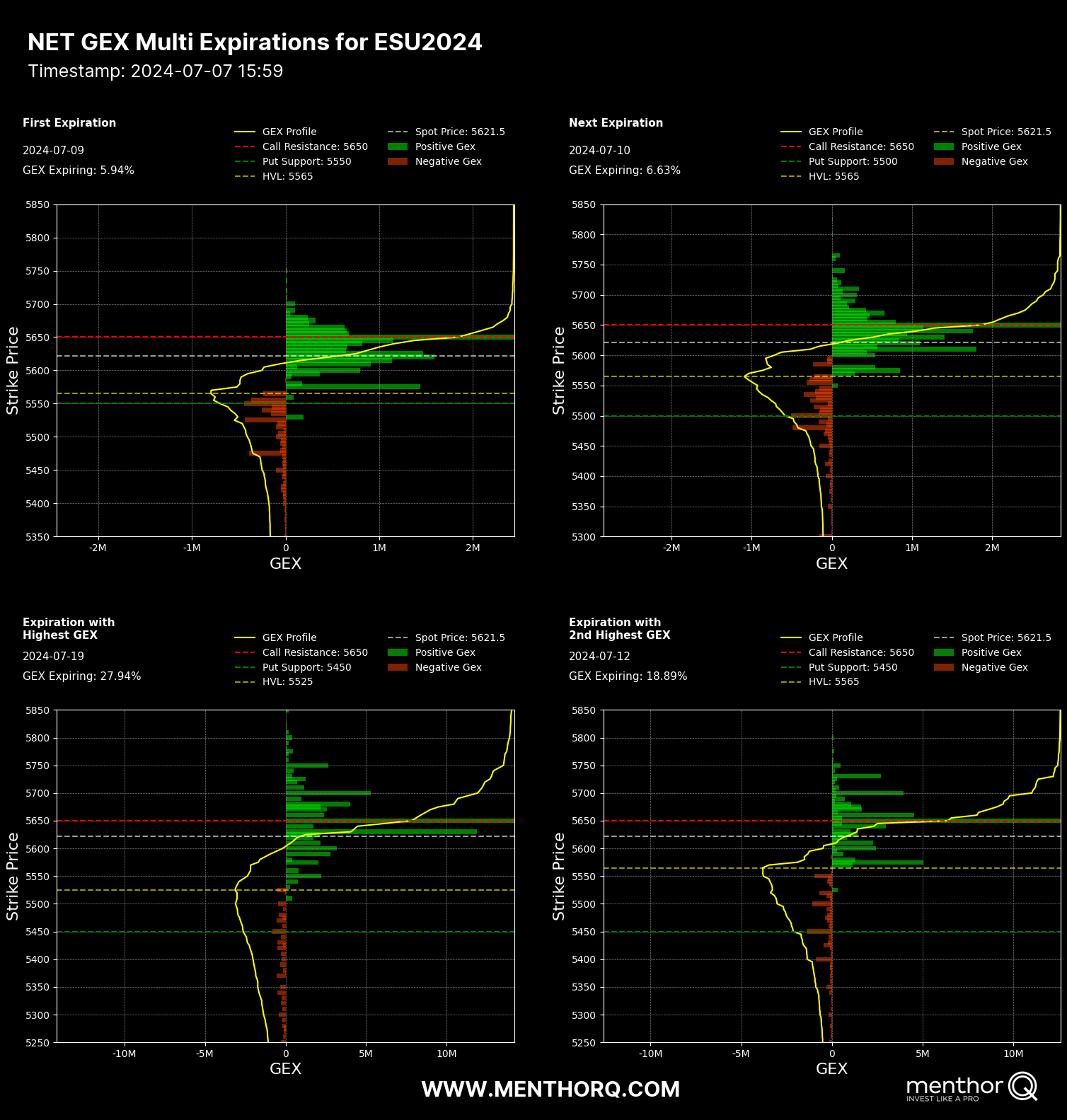

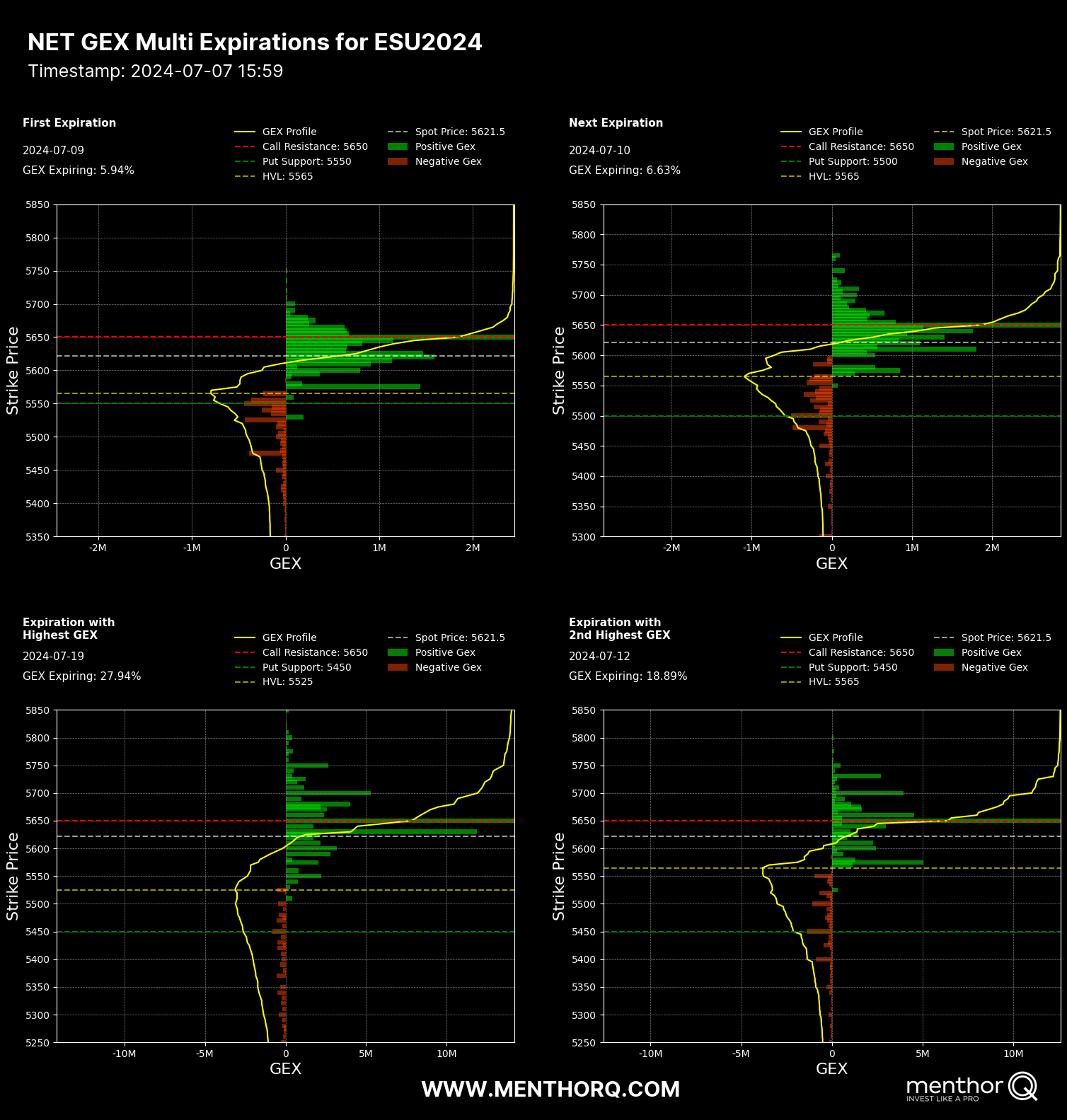

Net Gamma Exposure

Understand the net gamma exposure of market makers on futures options with our detailed analysis. This information helps you identify potential market reaction zones and anticipate price movements, giving you a clearer picture of market dynamics.

-

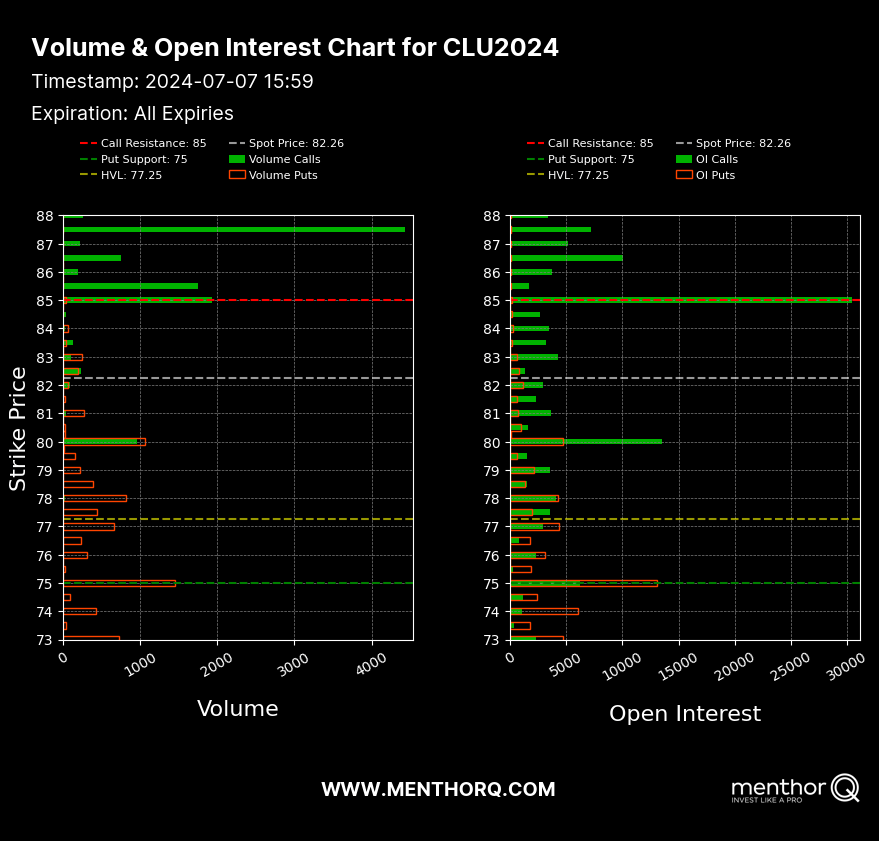

Volume and Open Interest

Analyze volume and open interest data to gauge market sentiment and liquidity. Our comprehensive tools provide insights into how these factors influence gamma levels, helping you make more informed trading decisions.

-

0DTE Levels

Monitor 0DTE (zero days to expiration) levels to stay ahead of market movements on the day of expiry. These critical levels offer insights into potential price action and volatility, enabling you to fine-tune your trading strategies for maximum effectiveness.

-

Data Simplified

Access a simplified option chain that highlights key gamma levels across various futures markets. Our user-friendly interface makes it easy to visualize and interpret complex data, helping you quickly identify trading opportunities and manage risks.

-

Extensive Coverage

We cover the following Markets and Futures:

- Index Futures: S&P 500 (ES), Nasdaq (NQ), Russell 2000 (RTY)

- Energy: Crude Oil (CL), Natural Gas (NG)

- Metals: Gold (GC), Silver (SI), Platinum (PL), Copper (HG)

- Rates: 2Y Treasury (ZT), 5Y Treasury (ZF), 10Y Treasury (ZN), 30 Treasury (ZB)

- Forex: EUR (6E), AUD (6A), GBP (6B), JPY (6J), CAD (6C), CHF (6S)

- Soft Commodities: Corn (ZC), Wheat (ZW), Soybean (ZS)