Volatility Control Fund Model

The Rising Influence of Systematic Funds

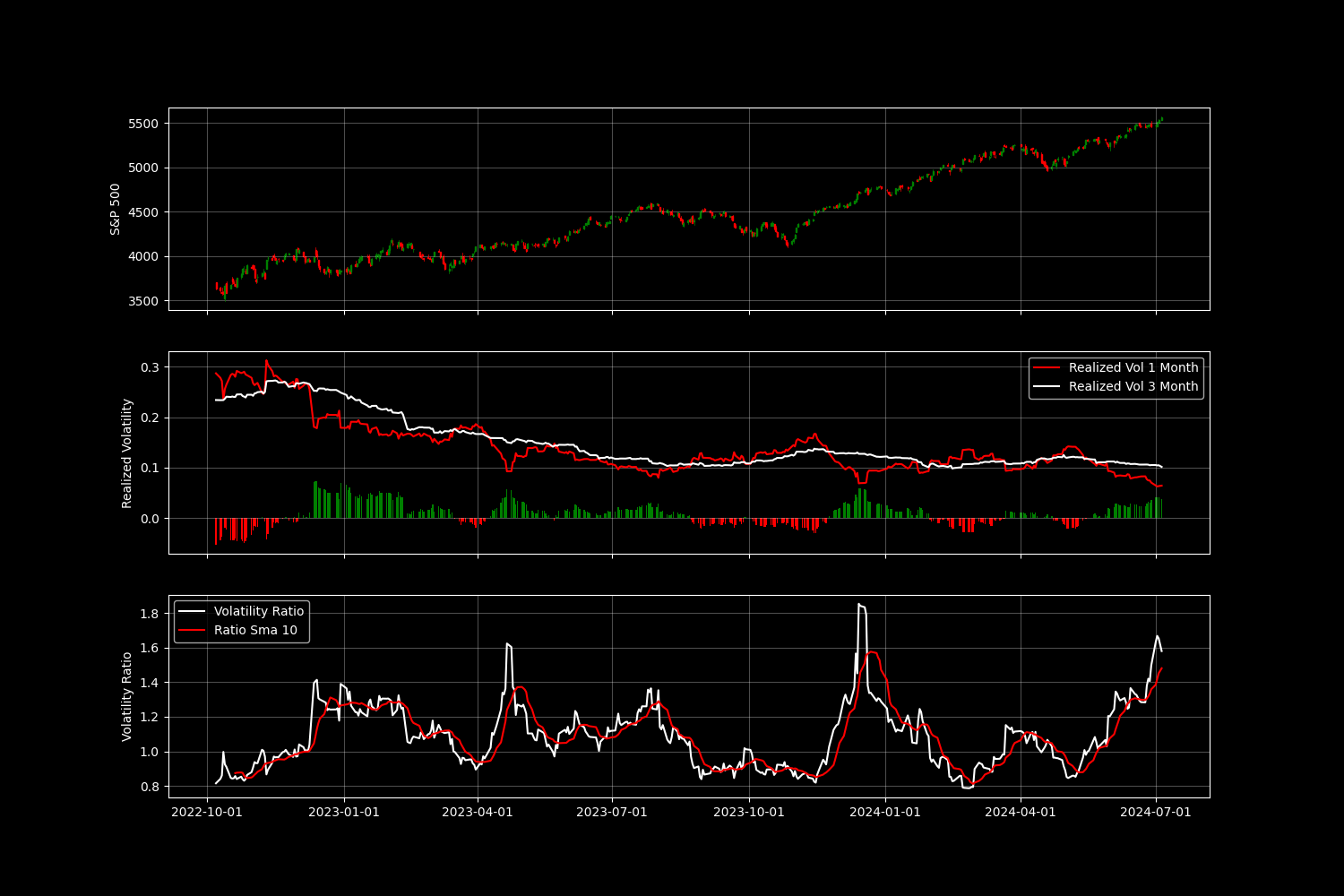

Volatility Control Funds are funds that go long or short based on realized and implied volatility levels. Like CTAs they have become key players in the market, important to track for liquidity purposes.

-

Systematic Flow

Combine Volatility Control Funds with Key Levels to gain clearer insights and accurately project key reaction zones

Compare 1-month realized volatility to 3-month volatility to determine when these funds are going long or short on equities, thereby adding or removing liquidity affecting your position

Tracking volatility control funds reveals their long and short positions based on market volatility. This helps you anticipate market movements and align your trading strategy. Optimize entry and exit points for better risk management and returns.

Volatility control funds go long on volatility and short on equities during strong increases in realized volatility. Tracking their positioning can enhance your own volatility and protection strategies.