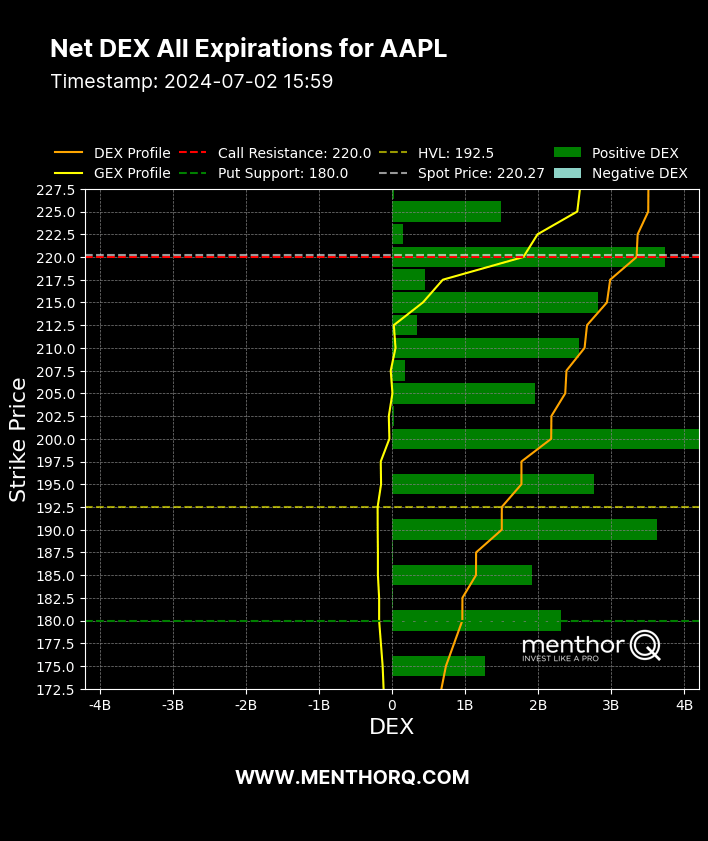

Net Delta Exposure

Leveraging Net DEX to decode Market Positioning

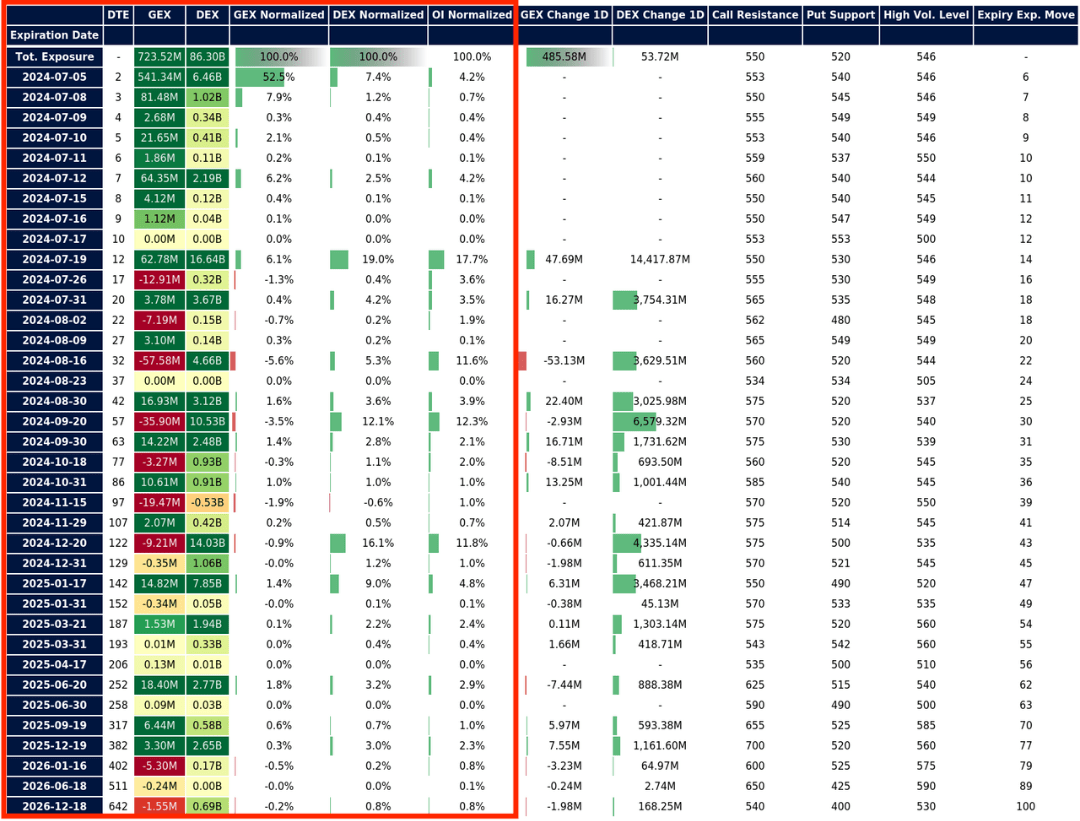

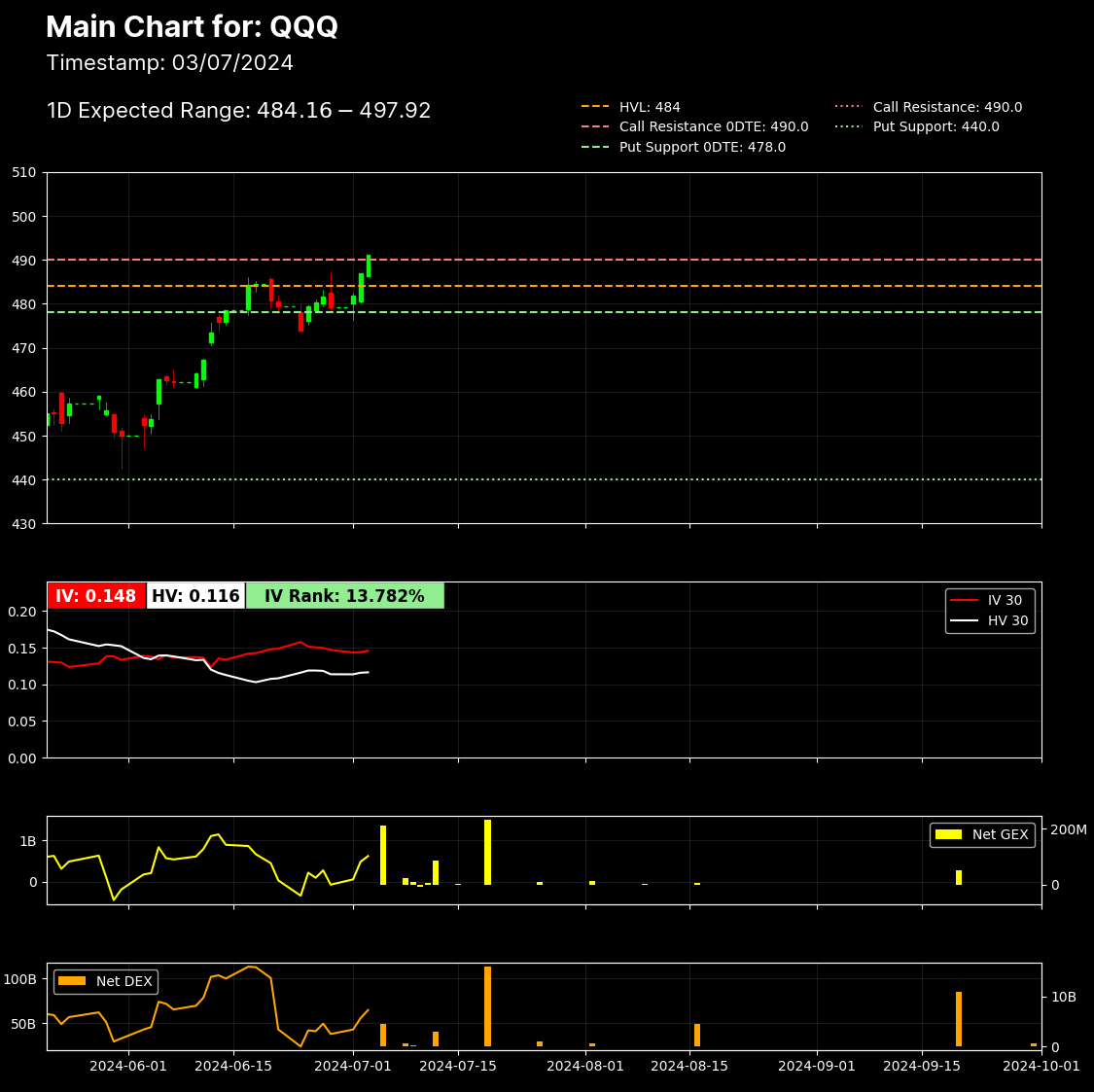

Delta Exposure or DEX, in options trading refers to the total delta of a portfolio of options. Delta measures the sensitivity of an option’s price to changes in the price of the underlying asset. Our DEX provides an aggregate measure of how much the overall portfolio of a market maker will change in value with a one-unit change in the underlying asset’s price.

-

Market Makers DEX

When a market maker has positive DEX, they will sell the underlying asset to achieve delta neutrality, resulting in a negative liquidity event for the market. Conversely, when they have negative DEX, they will buy the underlying asset, creating a positive liquidity event. Now you can track these movements.

-

Positive or Negative DEX

Positive DEX indicates a net long position benefits from upward movements, while negative DEX indicates a net short position benefits from downward movements.

-

Tracking DEX

Tracking DEX helps traders understand their exposure to directional movements in the underlying asset and manage risk accordingly. By tracking market maker DEX we understand their positioning.