Long Short Volatility Models

Insights from Our Long Short Volatility Model

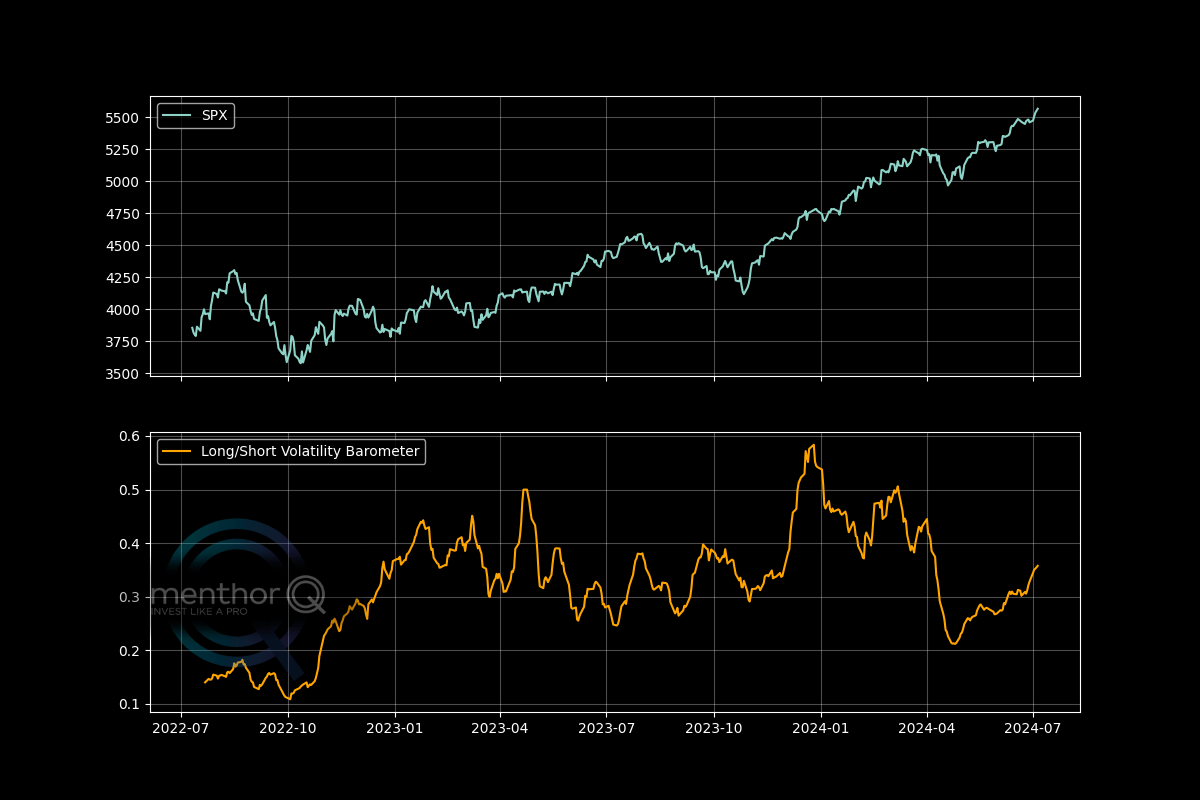

The model is a Volatility and Sentiment Index to better track market sentiment through volatility, focusing specifically on ETF market positioning. This index is based on data from ETFs that go long and short on volatility, analyzing volumes, open interest, and options greeks to determine if the market sentiment leans towards a long or short volatility positioning.

-

Market Sentiment

We analyse various ETFs, with half shorting volatility and the others going long. By examining the dollar volume traded in these ETFs, we create a proxy for market sentiment on volatility

- When the LSVB rises, it indicates increased shorting of volatility, suggesting bearish sentiment on volatility and bullish sentiment on the S&P 500. Divergence in this trend can be particularly insightful

- When the LSVB decreases, it indicates more people are buying volatility, suggesting bullish sentiment on volatility and bearish sentiment on the S&P 500