Volume and open interest are crucial metrics in options and futures trading, offering insights into market activity and sentiment. Volume measures daily trading activity, with high volume indicating strong interest and liquidity.

Open interest in options trading refers to the total number of outstanding options contracts that are currently active but have not yet been settled or closed. It represents the number of contracts that have been traded but not yet exercised, expired, or closed out by an offsetting trade.

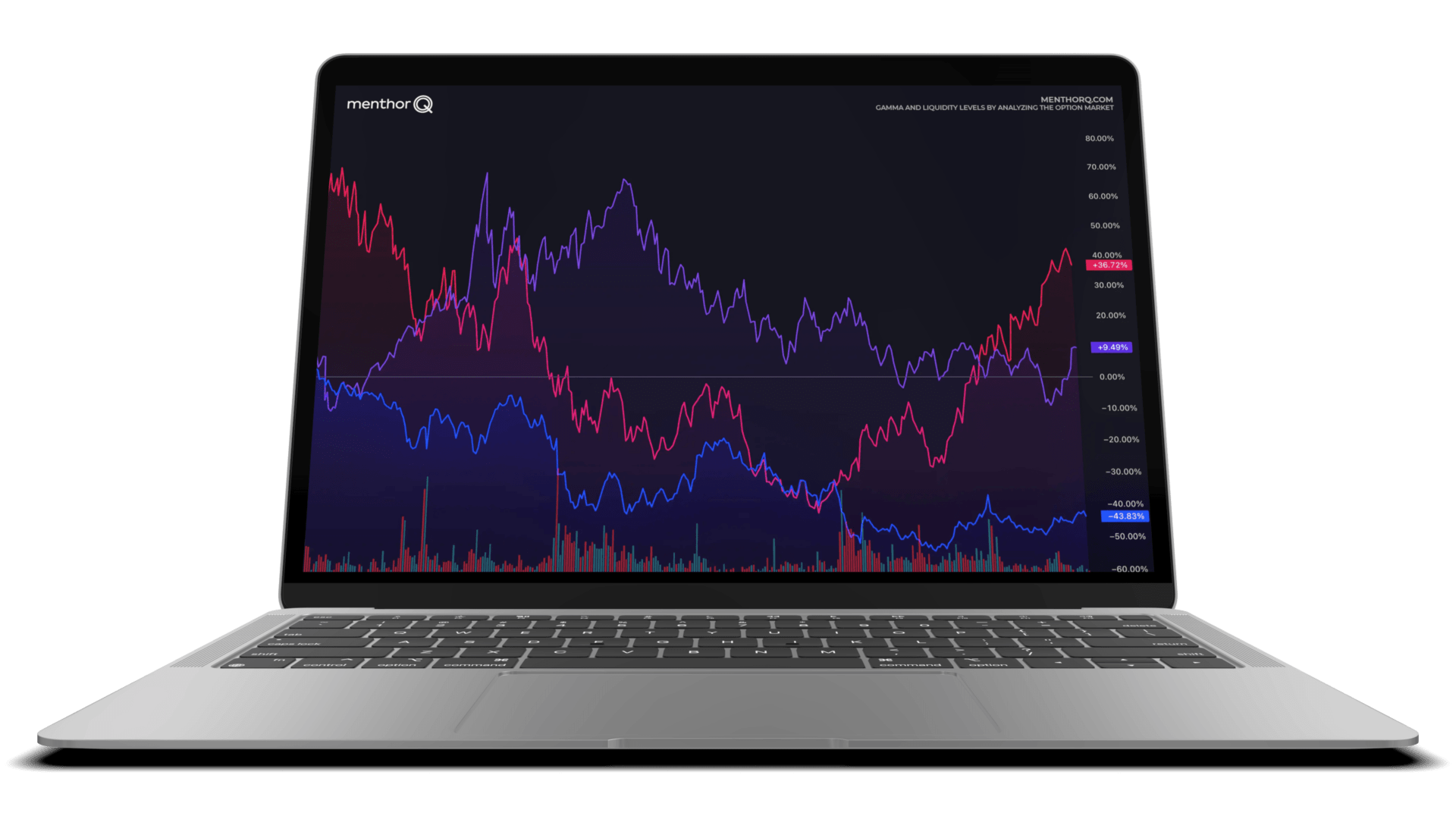

MenthorQ’s platform provides detailed charts that visualize these metrics, allowing traders to identify trends, reversals, and key support/resistance levels. By combining volume and open interest with other data models like Net GEX and Key Levels, MenthorQ helps traders refine their strategies to help discover market reaction zones.