Net Delta Exposure (Net DEX) is a critical metric for understanding market liquidity and potential price movements, as it reflects the overall delta exposure of market makers.

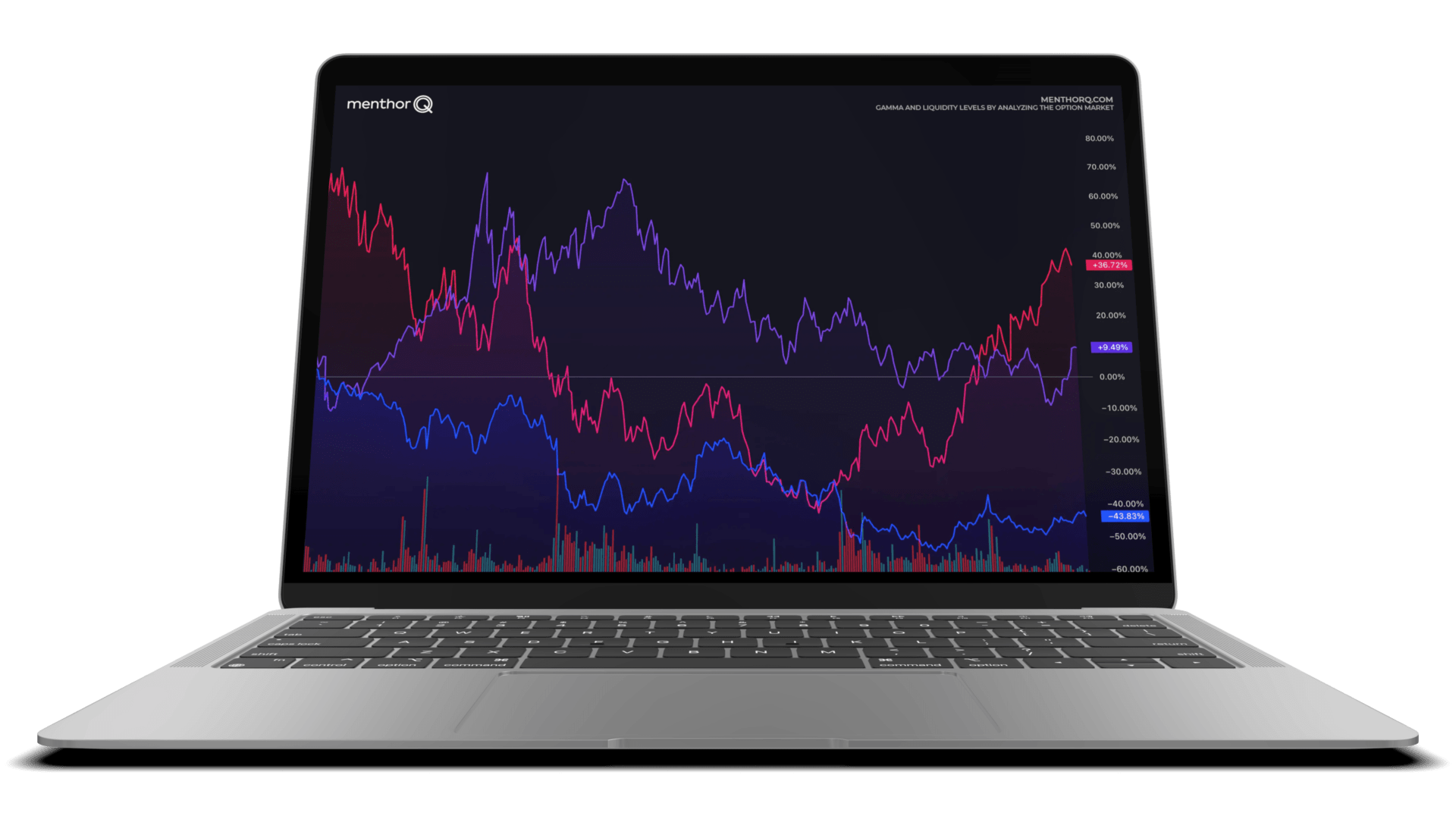

MenthorQ’s Net DEX tool helps traders track market makers’ delta positions, identify key support and resistance levels, and predict volatility.

By combining Net DEX with other indicators like Key Levels and Blind Spot Levels, traders can better manage risk, gauge market sentiment, and optimize their strategies for various market conditions.