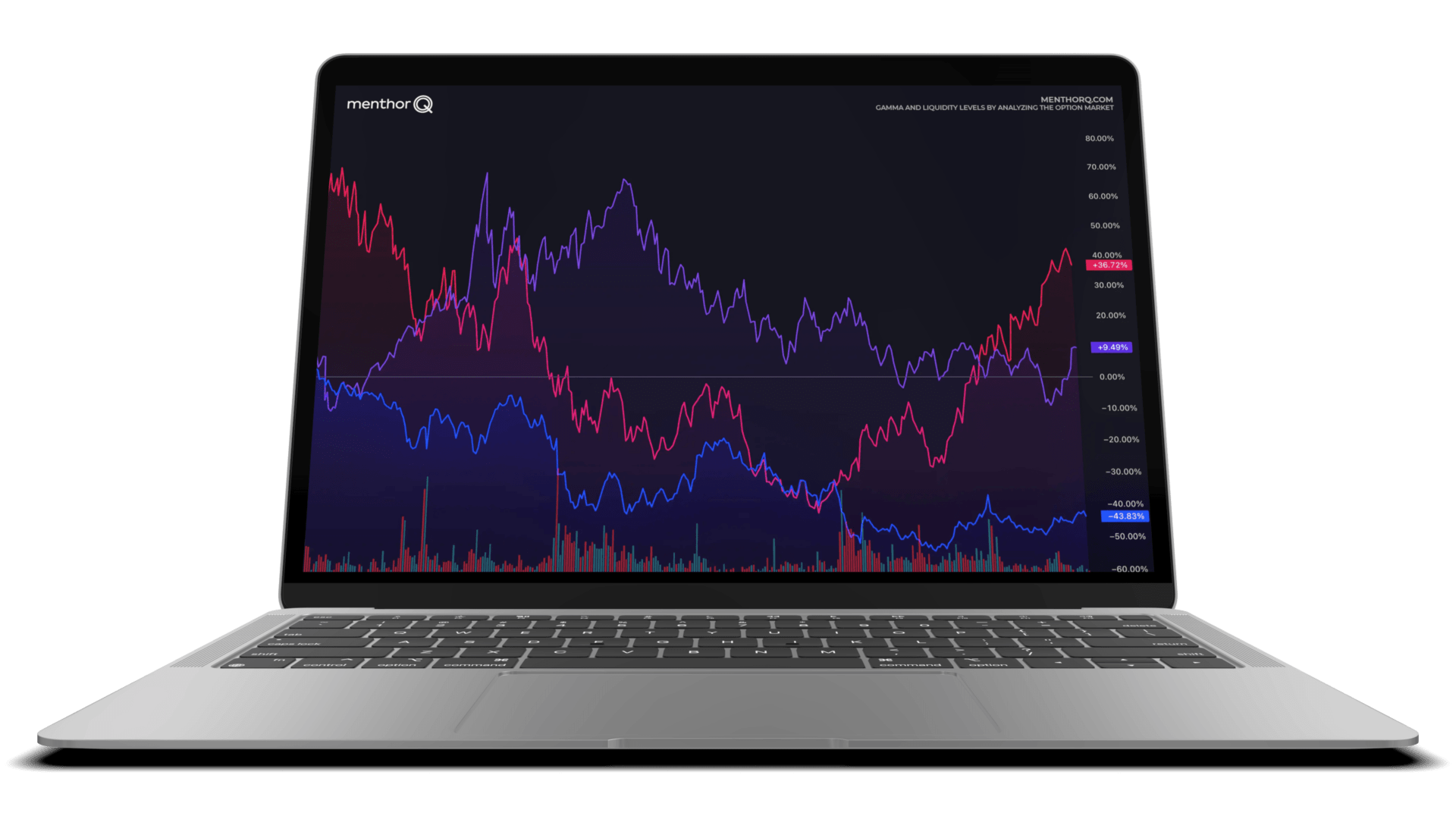

MenthorQ’s Skew provides a deep dive into options skew, revealing market sentiment through the pattern of implied volatility across different strike prices. By analyzing the 25-delta skew for various expirations (0DTE, 1 Month, 3 Months), traders can gauge bullish, bearish, or neutral market outlooks.

The 25-Delta Skew, often referred to as the 25d skew or risk reversal, compares the implied volatility of 25-delta put options to 25-delta call options. An increase in implied volatility of calls and puts can help traders understand how market is positioning and where market participants are positioning.

This tool helps in identifying entry levels, managing risk, and anticipating market movements, making it a key model for traders.