GEX Levels, or Gamma Exposure Levels, reflect how the collective positioning of market participants impacts market behavior. By analyzing GEX Levels, traders can better anticipate price reactions and optimize their strategies.

GEX Levels influence price movements, particularly around key strike prices, as market participants adjust their hedging strategies. Positive GEX can lead to upward momentum as traders buy more of the underlying asset to hedge, while negative GEX can cause sharp declines.

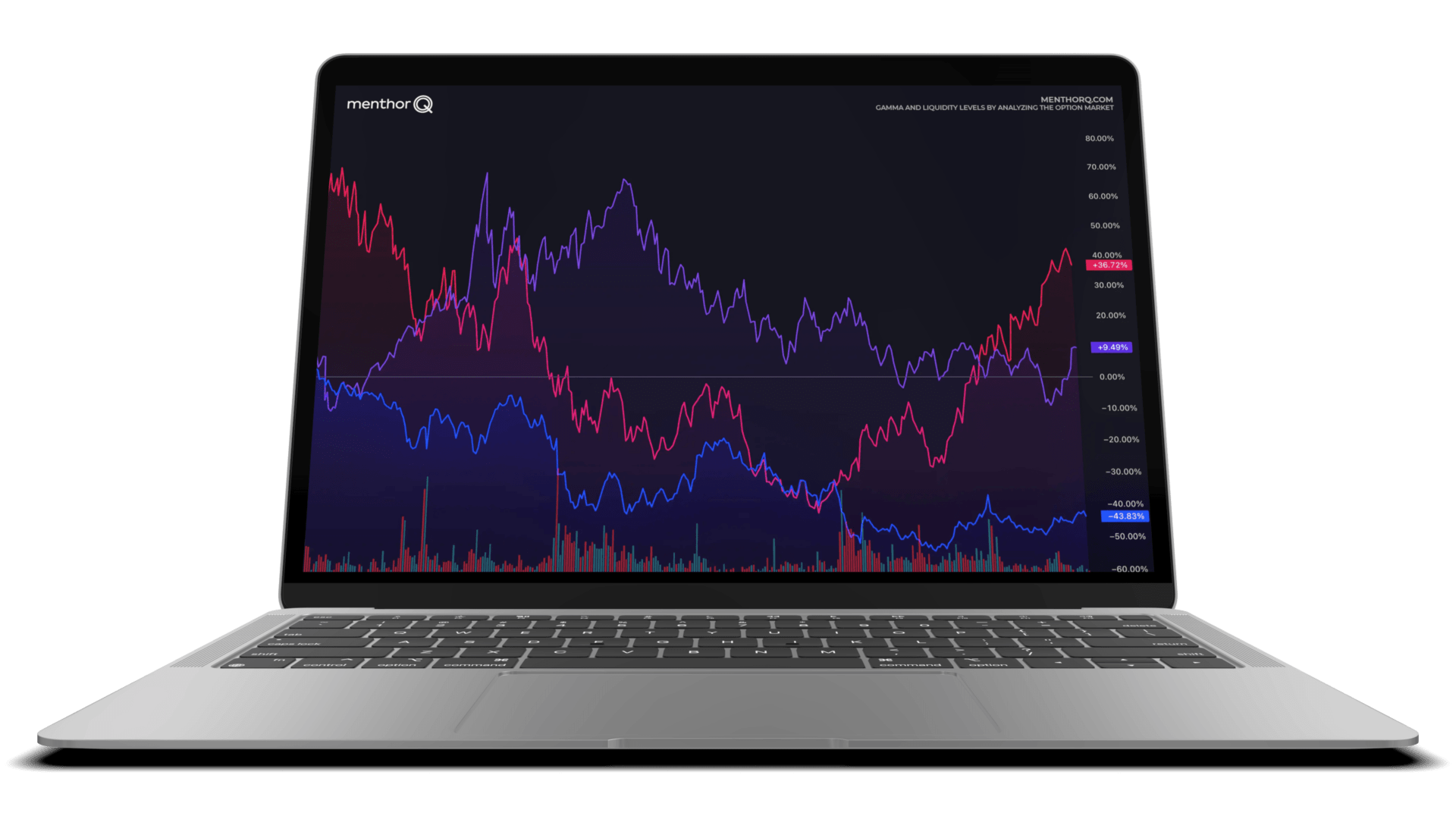

Tracking primary levels like Call Resistance and Put Support alongside secondary GEX Levels 1 to 10 provides a comprehensive view of potential price targets. Using Menthor Q’s tools, traders can effectively monitor these levels and make data-driven decisions.