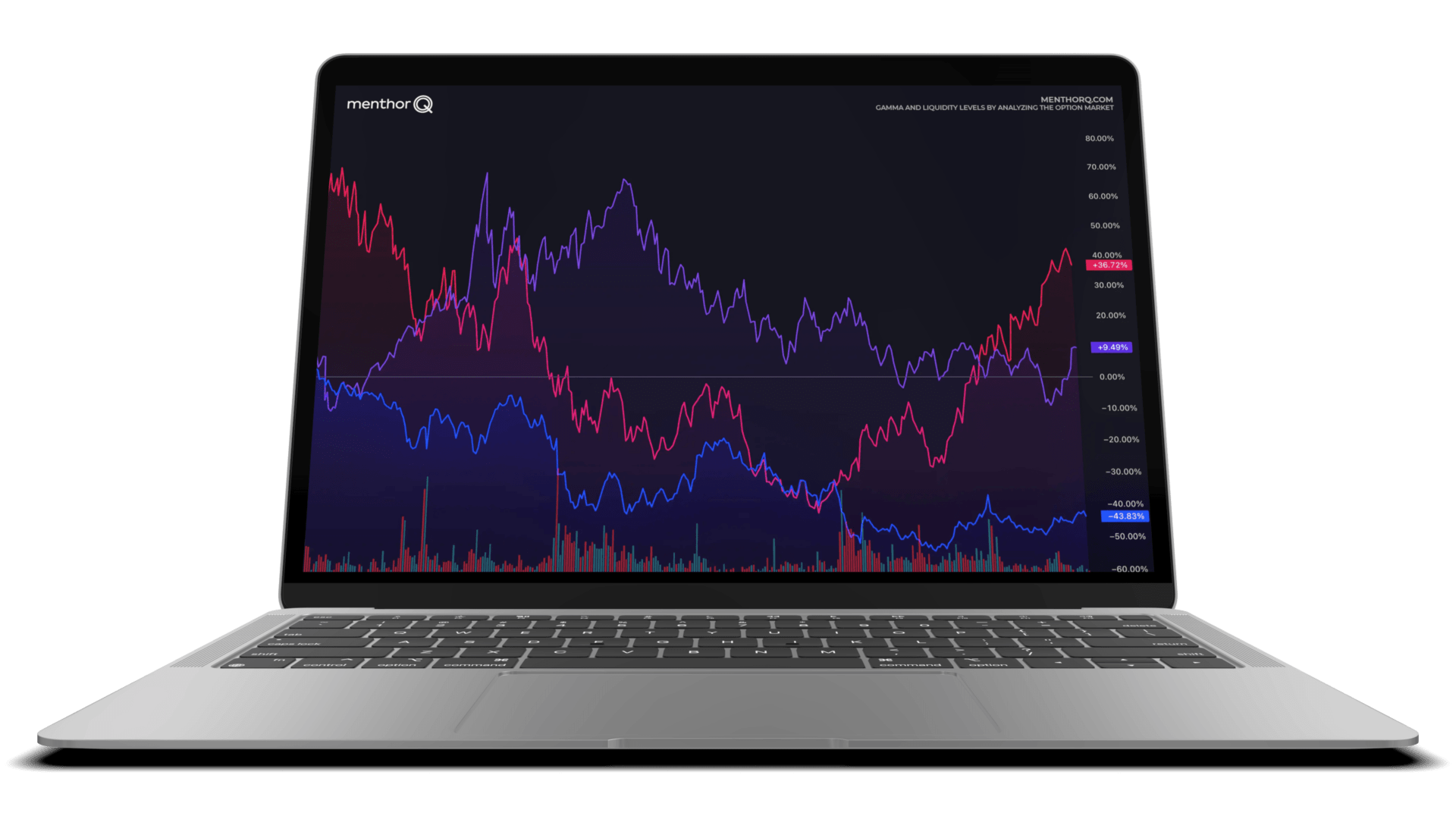

This guide dives deep into the secondary effects in the market, specifically through a case study on NVIDIA (NVDA) and how delta hedging, driven by Vanna and Charm, impacted its price action post-earnings. It provides insights into how options market positioning, particularly through the lens of Net Gamma Exposure (Net GEX), can influence market movements.

Prior to NVDA’s earnings announcement, a significant amount of put gamma activity was observed, skewed to the downside. This indicated that many market participants were positioned with out-of-the-money (OTM) puts, expecting the possibility of a downward move.