Key Levels on SPX, QQQ & VIX

Broad Market Coverage

SPX, QQQ, and VIX are key assets because they cover the broad market and tech sector. SPX reflects overall sentiment, QQQ leads tech movements, and VIX signals potential volatility.

Anticipate Market Momentum

Market Coverage

SPX and QQQ together provide a broad view of the overall market and the influential technology sector, helping traders understand market trends and sector-specific movements.

Anticipate Volatility

Monitoring VIX allows traders to anticipate market volatility and momentum shifts, enabling better risk management and strategic positioning.

Decision-Making

By analyzing these indicators, traders can make more informed decisions, predicting potential market direction and adjusting their strategies.

Early Market Signals

Moves in VIX often serve as early warning signs for broader market changes, giving traders an edge in anticipating and reacting to market momentum.

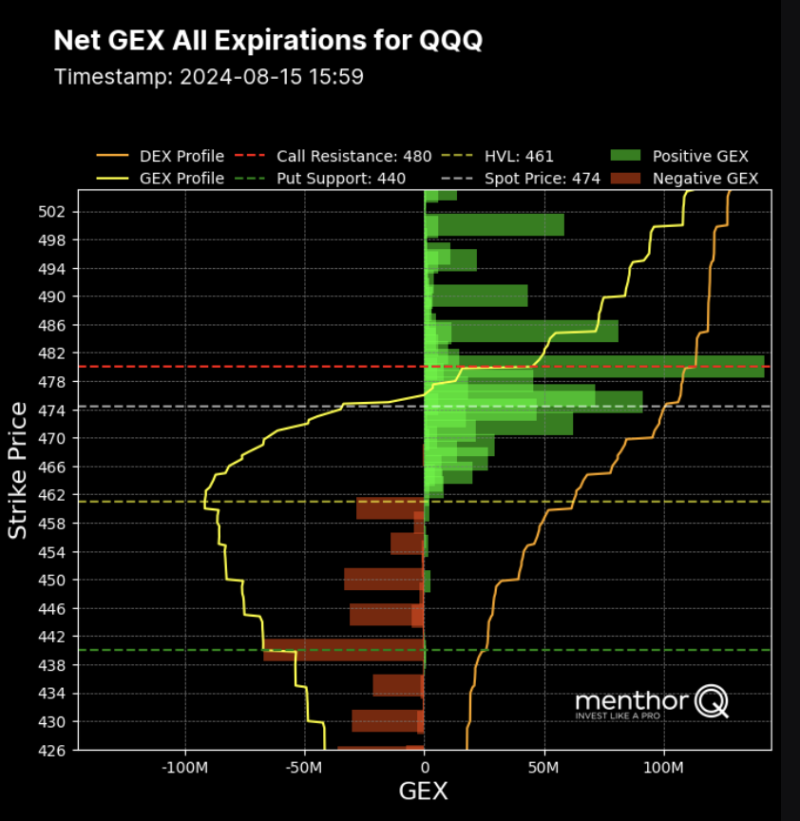

Gamma Levels and Data on SPX, QQQ and VIX

Access our Data and Models on SPX, QQQ and VIX giving you a comprehensive market coverage.

Q-Models

Access our Models on SPX, QQQ and VIX:

- Gamma Levels

- Net GEX

- Volume and Open Interest

- Option Matrix

Ready to transform

Your trading strategy?

Your trading strategy?