Gamma Levels on Stocks

Leverage Gamma Levels to Identify Key Market Reaction Zones

Gamma Levels are market reaction zones identified through market positioning and open interest data. By analyzing options data, we pinpoint these levels where there’s significant negative or positive gamma. These sticky price levels help traders formulate more effective trading strategies and better manage risk.

-

Trading Integration

Seamlessly integrate Gamma Levels into your existing trading platforms to gain a strategic edge. Our tools are designed to complement your current setup, providing real-time insights and enhancing your decision-making process without disrupting your workflow. Use Gamma Levels on NinjaTrader, MetaTrader and TradingView.

-

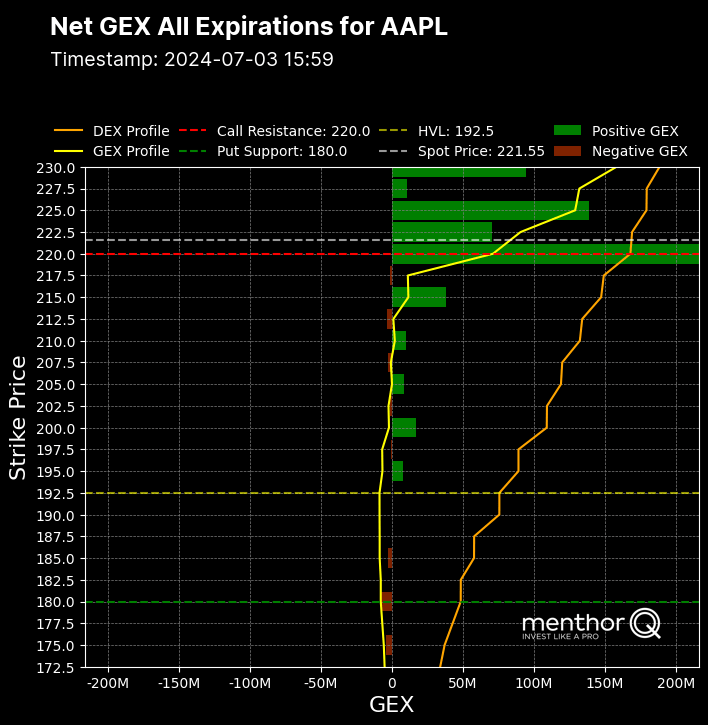

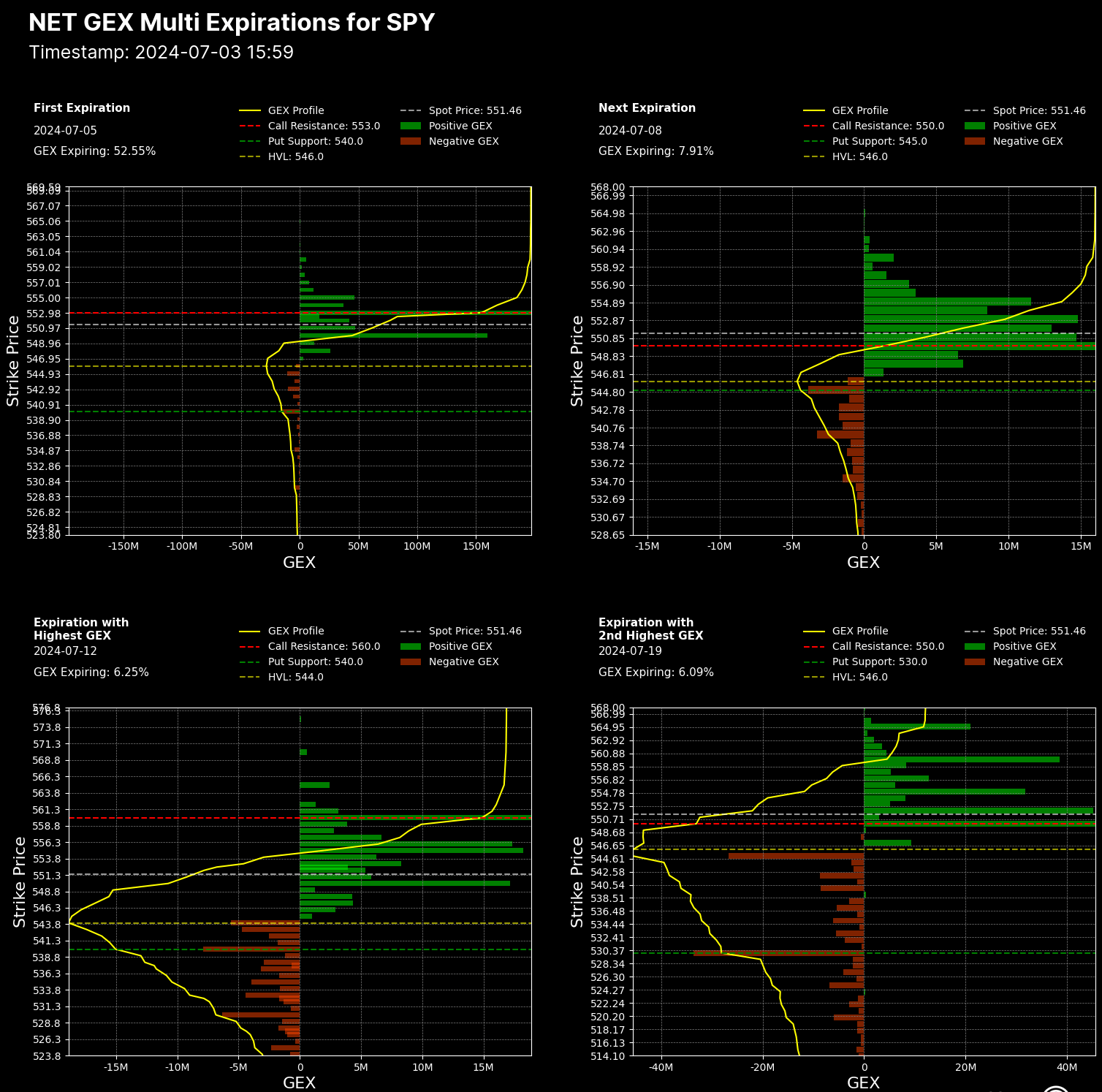

Net Gamma Exposure

Understand the net gamma exposure of market makers on stock options with our detailed analysis. This information helps you identify potential market reaction zones and anticipate price movements, providing a clearer picture of market dynamics.

-

0DTE Levels

Monitor 0DTE (zero days to expiration) levels to stay ahead of market movements on the day of expiry. These critical levels offer insights into potential price action and volatility, enabling you to fine-tune your trading strategies for maximum effectiveness.

-

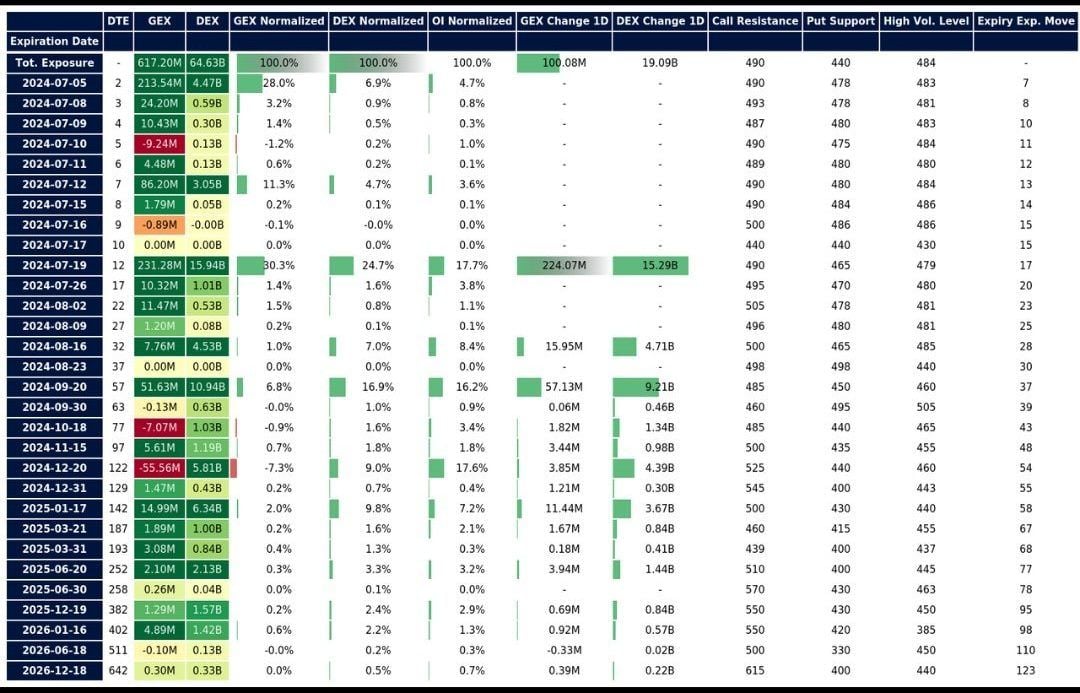

Simplified Option Chain

Access a simplified option chain that highlights key gamma levels across various futures markets. Our user-friendly interface makes it easy to visualize and interpret complex data, helping you quickly identify trading opportunities and manage risks.