Mean reversion strategies rely on the concept that asset prices tend to return to their historical average over time. These strategies are particularly useful in ranging markets and involve tools like Moving Averages and Bollinger Bands to spot significant deviations from the mean.

In options trading, traders compare implied volatility (IV) to historical volatility (HV) to identify overbought or oversold conditions. When IV is high relative to HV, selling options may be advantageous; when IV is low, buying options may be more favorable.

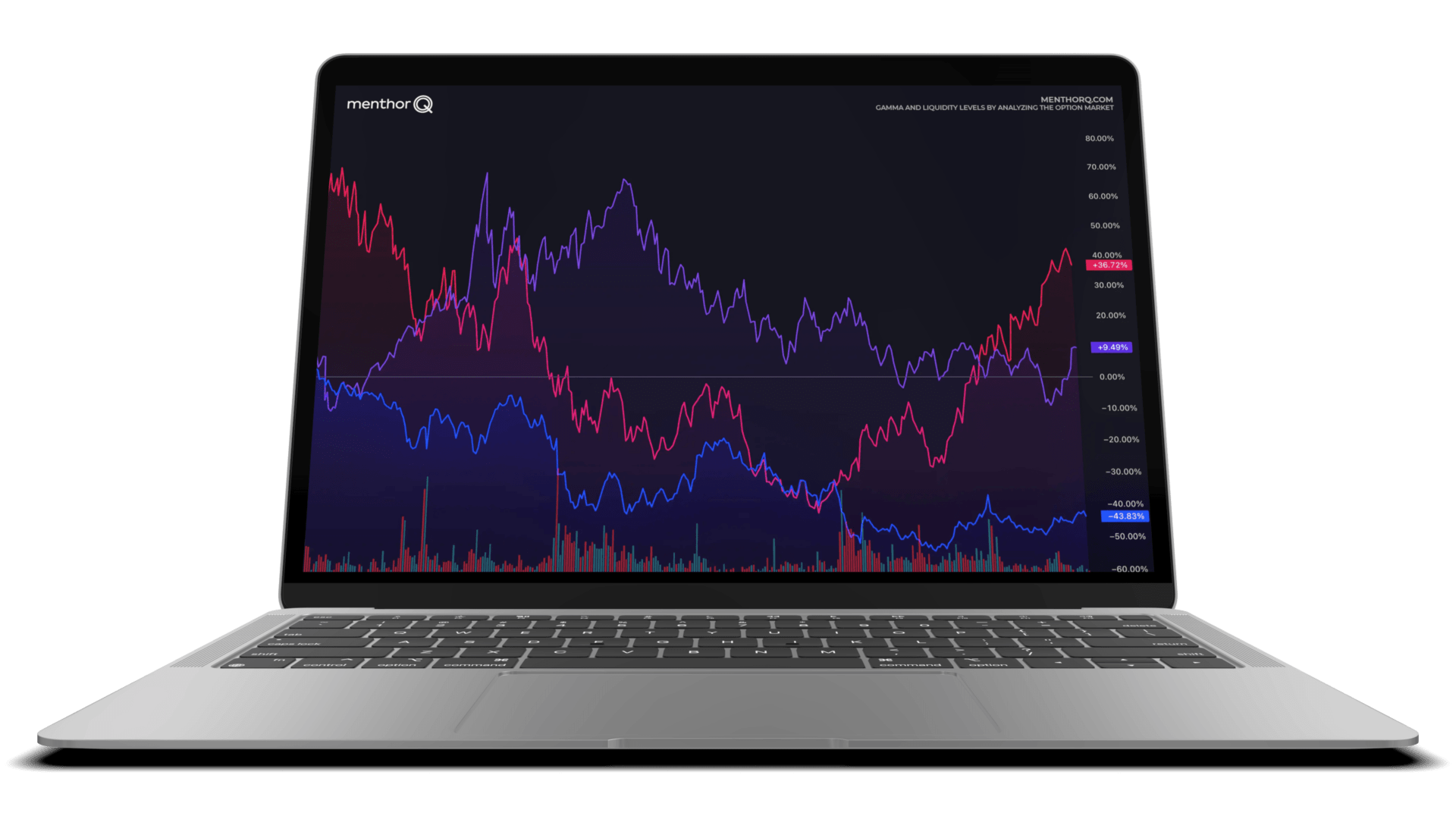

MenthorQ provides models and indicators to help traders effectively apply these strategies, ensuring better risk management.