Gamma Levels on Crypto

Transform your Crypto Trading with Options Data

Designed for traders looking to gain a competitive edge, this tool allows you to track the gamma exposure on crypto futures options. By pinpointing key Market Reaction Zones, you can anticipate price action and make data-driven decisions.

-

Gamma Levels on Crypto

Seamlessly integrate Gamma Levels into your existing trading platforms like TradingView and more. Leverage our indicators and the power of options data to give you better confirmation when trading.

-

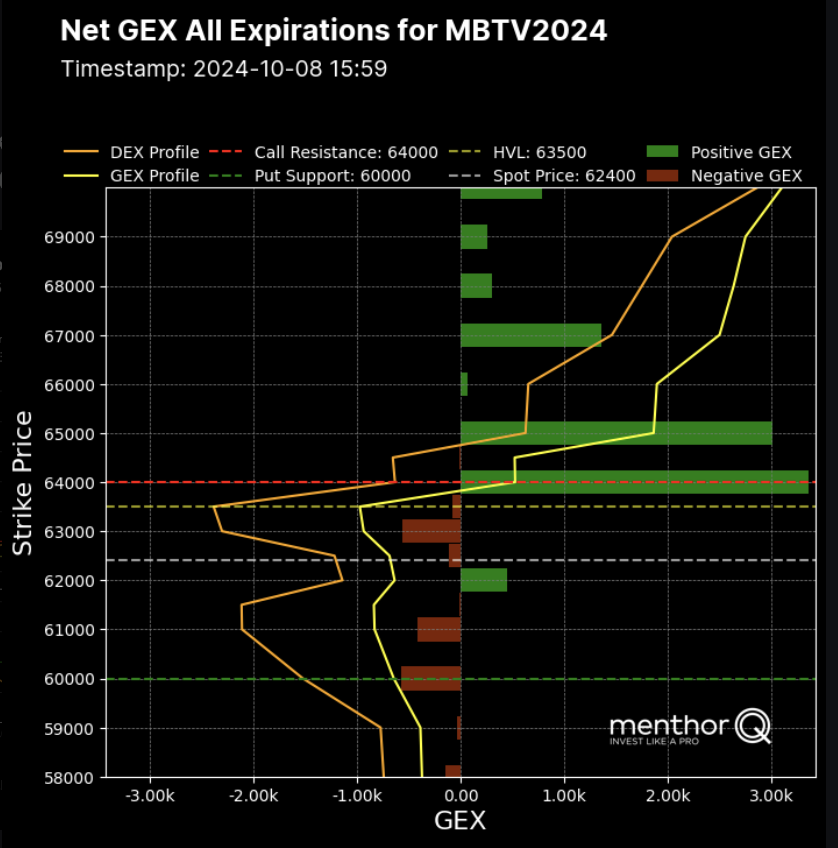

Net Gamma Exposure

Understand the net gamma exposure of market makers on futures options with our detailed analysis. This information helps you identify potential market reaction zones and anticipate price movements, giving you a clearer picture of market dynamics.

-

Blind Spots Levels

Our Blind Spots indicator helps you identify hidden areas of the market where traders may be unaware of significant risks or opportunities. By pinpointing these blind spots in crypto, you gain insights into price zones that are often overlooked but can lead to major price shifts.

-

Asset Correlation

As the correlation between cryptocurrencies and traditional markets like the S&P 500 (SPX) grows, it’s more important than ever to track how movements in one market influence the other. Our advanced indicator allows you to convert gamma levels from any asset—whether it’s SPX, commodities, or forex—directly into actionable insights for any crypto assets.